Curious about what’s happening with mortgage rates in 2024? It’s a hot topic right now. Experts say rates might drop to about 6% after hitting nearly 8% due to recent changes by the Fed. But here’s the deal: understanding these predictions feels like a rollercoaster. Some experts say rates might drop further, while others predict stability or even slight increases. It can all be a bit confusing, especially for non-U.S. citizens and U.S. expat investors who are new to this market.

It’s worth noting that many discussions about future rates do not come directly from the Fed. Instead, they are interpretations made by experts using current economic data. These interpretations can vary widely, making it unwise to rely solely on interest rate predictions when making real estate decisions.

What could interest rate cuts mean for the U.S. 2024 election?

Arriving less than a year before the presidential contest, the announcement raised a separate consideration: What the rate cuts could mean for President Joe Biden’s re-election bid.

“A good economy benefits an incumbent,” Ray Fair, a professor at Yale University who oversees a model that forecasts elections based on economic conditions, told ABC News. “A bad economy goes the other way.” Will this be used as a tool to boost the economy and potentially get Biden re-elected? That seems to be the million-dollar question.

In theory, lower interest rates make borrowing less expensive for businesses and consumers, propelling companies to invest in new projects and everyday people to stretch for bigger purchases. That all should help propel economic growth and buoy consumer optimism.

In turn, a major economic surge could benefit Biden, dispelling concern about a recession and improving the livelihoods of everyday people, as suggested by some analysts.

Time will tell.

What will happen to U.S. real estate prices if interest rates are lowered?

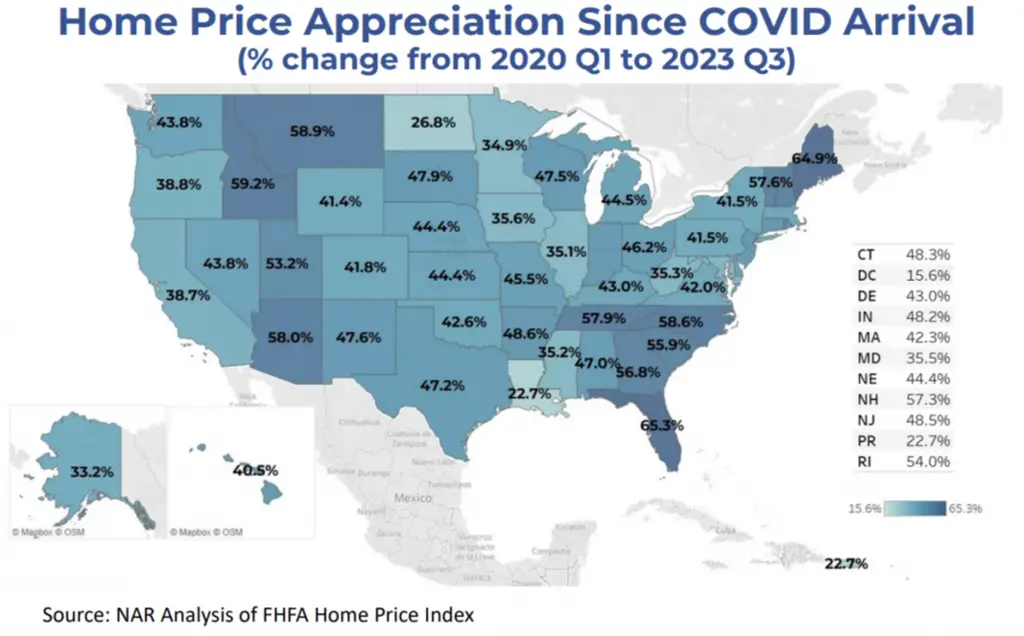

The experts we spoke with agree that a drop in interest rates will likely drive up demand, which, in turn, will drive up home prices. They anticipate that the resulting supply-demand imbalance will further drive up prices.

What are we recommending at America Mortgages?

If you believe the writing on the wall and find yourself on the fence, weighing whether to buy now or wait for further interest rate drops, consider this: you may miss out on the potential appreciation of the property. You can always refinance a property when it makes sense. You can’t always get the best price when you buy.

So, if you’re thinking about investing in U.S. real estate in 2024, ask yourself: would you want to pay a lower price for the home and maybe have a higher interest rate but have the option to refinance if rates go down? Or would you want a lower interest rate, even if it means paying more for the home and not being able to refinance later?

We are the industry experts for U.S. real estate financing for non-U.S. residents.

At America Mortgages, we’re here to help you make sense of all this. Our team knows the market inside out and can guide you through these tough decisions. As experienced investors know, timing is key in real estate. “Realizing success in real estate often comes down to seizing the opportune moment,” says Robert Chadwick, CEO of America Mortgages. Instead of being overwhelmed by unpredictable rates, let us help you achieve your real estate goals.

- Get pre-approved today with our diverse loan services and products, including pure cash flow loans requiring no personal income documentation.

- Use our expertise to navigate complex markets.

- Get personalized guidance throughout your journey.

At America Mortgages, we offer a range of loan programs tailored to meet your specific needs.

Our AM Rental Coverage program is designed for investors seeking to finance rental properties smoothly. With flexible terms and competitive rates, growing your real estate portfolio has never been easier.

For homeowners looking to combat inflation and tap into their home’s equity, our Equity Release Loan Program provides a solution. This program allows you to access your home’s equity to fund expenses or investments while keeping your monthly payments manageable.

Need short-term financing to bridge the gap between buying a new home and selling your current one? Our AM Real Estate Bridge Loan program has you covered. With quick approval and hassle-free processing, you can confidently make your move.

So, whether you’re taking your first steps into real estate investment, are an experienced investor, or are anywhere in between, America Mortgages has the expertise and loan programs to help you achieve your real estate goals. Reach out to us today, and let’s turn these market predictions into real success! If you’d like to schedule a commitment-free meeting with one of our U.S. loan officers to explore your U.S. mortgage options.

Reference: https://www.americamortgages.com/curious-about-2024-u-s-mortgage-rates/