Introduction

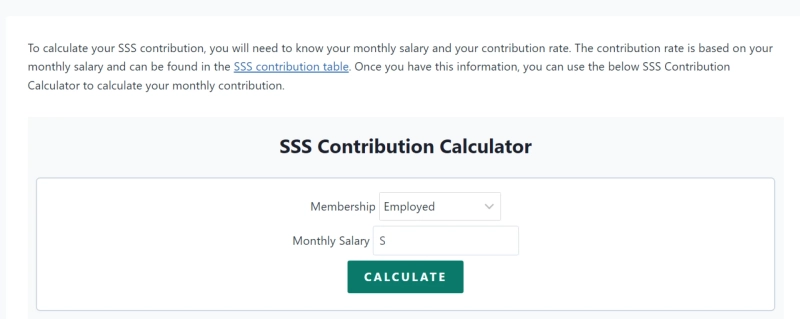

Employers play a critical role in ensuring their employees\' Social Security System (SSS) contributions are accurate and up-to-date. The SSS Contribution Calculator is an essential tool for employers in this process. This article explores how the calculator helps employers ensure accurate SSS contributions for their employees.

Employer Responsibilities

Employers are responsible for:

- Calculating Contributions: Accurately calculating both the employee and employer shares of SSS contributions.

- Timely Payments: Ensuring timely payment of contributions to avoid penalties.

- Compliance: Staying compliant with SSS regulations and keeping up-to-date with rate changes.

Using the SSS Contribution Calculator for Employers

Accurate Calculations

- Employee Salaries: Input each employee\'s salary into the calculator to determine their SSS contributions.

- Latest Rates: Use the latest SSS rates provided by the calculator to ensure accurate calculations.

Managing Contributions

- Detailed Breakdown: The calculator provides a detailed breakdown of contributions for each employee, helping employers manage payments effectively.

- Compliance: Ensures that contributions are compliant with the latest SSS regulations.

Projecting Future Contributions

- Salary Increases: Project the impact of salary increases on future contributions.

- Benefit Maximization: Help employees understand the importance of accurate contributions for maximizing their benefits.

Case Studies

Small Business

- A small business owner can use the SSS Contribution Calculator to manage contributions for their employees, ensuring accuracy and compliance.

Large Corporation

- A large corporation\'s HR department can use the calculator to ensure that all employee contributions are calculated accurately and updated regularly.

Conclusion

The SSS Contribution Calculator is an invaluable tool for employers to ensure accurate and compliant SSS contributions. By providing detailed breakdowns and using the latest rates, it helps employers manage contributions effectively and avoid penalties. Regular use of the calculator can enhance compliance and benefit both employers and employees. visit this page to get sss mat 1 form