The acceptance of electronic payment for online transactions is facilitated by an ecommerce payment processing (also known as an electronic payment system). Due to the extensive usage of internet-based shopping and banking, e-commerce payment systems, often known as a subcomponent of electronic data interchange (EDI), have grown in popularity.

Methods Of Online Payment

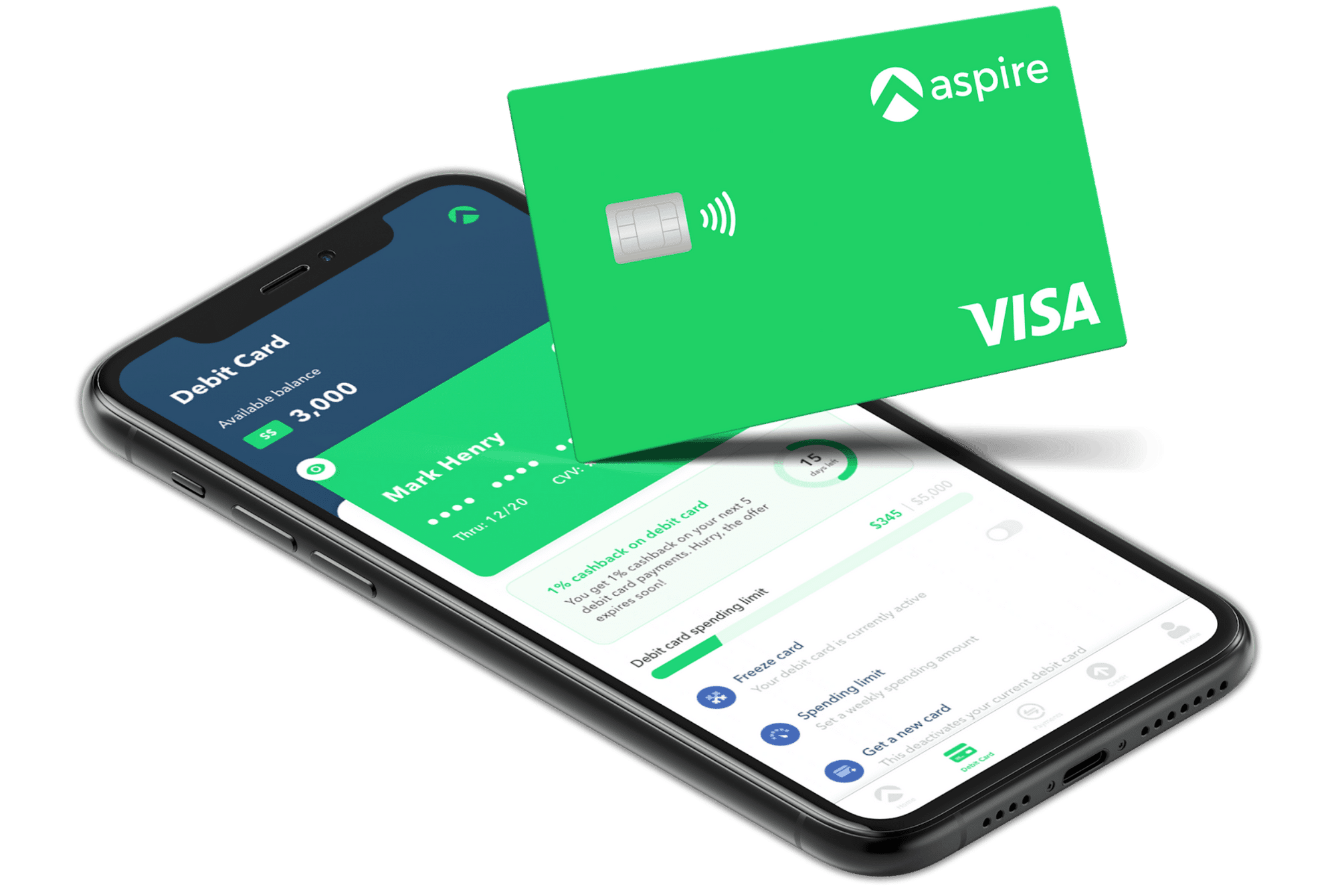

Let's have a look at some of the many payment options clients choose for online transactions before we get into how payment processing works by Aspire:

Credit cards:- One of the most common and simple methods of payment, both offline and online.

Direct debit:- Customers can submit their bank account information, equating it to paying with cash or a cheque.

Digital currency:- Only a small percentage of users use Bitcoin or another cryptocurrency to make payments.

You can also give your clients extra options for paying online throughout the checkout process, such as ACH and invoicing. When two or more parties have coded to an api, it is called bank api integration. This enables APIs to give all of their benefits. However, as shown in the graph below, the majority of individuals choose credit cards, alternative payments, and direct debit.

Payment Processing In Ecommerce Has Three Components

It's time to talk about ecommerce payment processing now that we know what forms of payments you can accept on your online store. While there's a lot more to it than that, defining each of the aspects fast is a good approach to describe the concept:

Payment gateways:- serve as a link between your ecommerce website, where customers enter payment information, and your payment processor.

Payment processors:- Obtain information from the gateway, confirm that the consumer has sufficient funds, and transfer the monies into your merchant account.

Merchant accounts:- Once the monies have been processed, you will receive them.

Even though they officially do separate things, people sometimes use the terms gateway and processor interchangeably, which adds to the confusion. Digital banking singapore offers have always been intriguing.

What Is The Relationship Between Ecommerce Payment Processors, Gateways, And Merchant Accounts?

Now that we've covered each component, let's walk through the processes of a typical transaction to show how the payment systems interact once the user has done adding items to their cart by Aspire:

* At checkout, the customer inputs their credit or debit card information.

* The data is encrypted and sent to the payment processor through the payment gateway.

* The payment processor verifies that the consumer has sufficient funds to cover the purchase by contacting the credit card network.

* The payment request is either accepted or rejected by the customer's credit card issuing bank.

* The payment processor subsequently delivers the findings (approved or rejected) to the payment gateway, where the customer can see if the transaction was approved on the merchant's website.

* The money is sent to the merchant account or the merchant's bank by the payment processor.

The fact that the entire process happens in a matter of seconds, despite the fact that a lot is going on, is sometimes startling.

Using Ecommerce Payment Gateways To Collect Data

As previously stated, the payment gateway's primary function is to connect the customer's payment information with the financial institutions responsible for ecommerce payment processing. There are four basic choices for collecting payment details on your big commerce store for small business owners, some more customisable than others.

Widgets that are hosted – You utilise an html component to display information on your checkout page in this scenario. You can utilise two different types of hosted widgets:

* Embedded iframe components:- Because the content on your checkout page is housed outside of big commerce, you have no control over the appearance and feel.

* DIV components:- Big commerce hosts the content displayed on your checkout page, which can be dynamically produced using javascript.

Fields that are hosted – Another way to keep your customers on your checkout page while adding an extra layer of security to their credit card information is to use hosted fields. The form fields are hosted outside of big commerce but displayed on the checkout page using this option.

Component that is hosted locally:- This option keeps the customer on the page while big commerce renders the fields during checkout. The PSP is then connected to big commerce using a server-to-server (direct) API interface. PSPs like Authorize.net and Cybersource can help you with this.