Introduction to Crypto Wallets

Whether you’ve decided to trade cryptocurrencies full-time or are just a beginner looking to buy some tokens and hold onto them, you’ll need a crypto wallet to store your assets.

Actually, a crypto wallet doesn’t store your cryptocurrencies directly; it stores your public and private keys and uses them to sign transactions.

If you’re confused about what that means, this article will explain what a crypto wallet is, how it works, the difference between public and private keys, the many kinds of crypto wallets, and how to pick the most appropriate one for your requirements.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows you to store, trade, send, and receive cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

Similar to a traditional wallet that holds cash, crypto wallets come in various forms such as software on your computer or smartphone, browser extensions, or physical devices. For those new to the space, understanding how to buy your first Bitcoin and other cryptocurrencies is crucial.

Misconceptions About Crypto Wallets

A common misconception is that your cryptocurrencies are stored inside your wallet. In reality, crypto wallets generate and store two important pieces of information: your public key and your private key.

- Public Key: your wallet address, which you can share with others to receive payments. It’s similar to your bank account number or PayPal email address.

- Private Key: This is like the PIN for your debit card or your PayPal password. It should be kept private, as anyone with access to it can control and spend all your money.

Losing your private key means losing access to your wallet and all the funds in it. The private key is used to sign or approve transactions from your wallet.

While you can create multiple public keys linked to the same private key, it’s impossible to generate a private key from a public key.

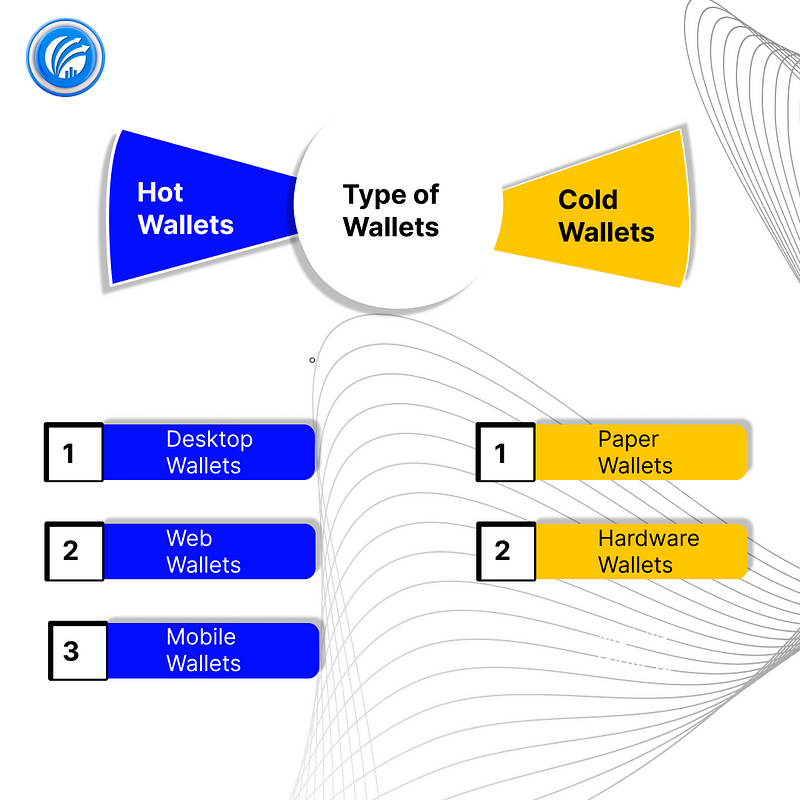

Types of Crypto Wallets

Crypto wallets are generally categorized into two types: hot wallets and cold wallets.

Hot Wallets

Wallets that are connected to the internet are called software wallets or hot wallets. They come in several forms:

- Desktop and Mobile Applications: Examples include Exodus Wallet.

- Browser Extensions: An example is MetaMask.

- Web Wallets: Provided by global cryptocurrency exchange platforms like Koinpark, Coinbase, and Binance.

Hot wallets are popular among beginners because they are free, easy to set up and use, and make your crypto easily accessible.

However, the private keys are stored in the app itself, which is connected to the internet, making them vulnerable to digital hacks.

If you use exchange wallets, your private keys are stored on the exchange’s databases, not with you.

The phrase “not your keys, not your crypto” highlights that if you don’t own your private key, you don’t truly own your crypto. While convenient, hot wallets carry the risk of digital hacks.

For example, in 2020, KuCoin, a Global Cryptocurrency Exchange, was hacked, and over $200 million was stolen. The exchange refunded users, but it’s a reminder not to store large amounts in hot wallets.

Cold Wallets

Cold wallets are offline wallets that store your private keys securely away from the internet, minimizing the risk of cyber attacks. They come in two forms:

- Paper Wallets: These involve writing down your public and private keys on a piece of paper. While secure, losing or destroying the paper means losing your crypto, making it less convenient.

- Hardware Wallets: These are physical devices resembling USB sticks. Hardware wallets store your keys locally and require you to enter a PIN to approve transactions, offering unmatched security. They also come with a seed phrase, a 24-word sentence used to back up your private key. If you lose your device, you can use the seed phrase to restore your keys and crypto.

While secure, hardware wallets have drawbacks such as cost (ranging from $50 to $200) and less convenience compared to hot wallets.

Choosing the Right Wallet

Your unique demands will determine which wallet is perfect for you:

- For small amounts, an exchange wallet or a software wallet like Exodus or MetaMask will suffice. If you’re learning how to buy Bitcoin in India, these wallets can be especially helpful.

- For large amounts, keep a small portion in an exchange wallet for quick trading and the rest in a software or hardware wallet.

- For long-term holding, a hardware wallet is the most secure choice.

Conclusion

Always do your research before making any decisions in the crypto world. We hope this article has helped you understand what you need to know about crypto wallets.

From knowing the best way to buy crypto to understanding the nuances of different wallets, being informed is key. If you need to convert your crypto, knowing the BTC to INR or USDT to INR rates can be crucial for making informed decisions.

Additionally, staying updated with Token Listing events can help you seize new opportunities in the market.