The Finance Ministry last week unveiled the Account Aggregator (AA) network in banking with eight of India’s largest banks. An Account Aggregator Network is a financial data – sharing system. The network will revolutionize the investment and credit markets, and shall give millions of customers greater access and control over their financial records and expanding the potential pool of customers for lenders and fintech companies. It is a kind of dashboard of all our financial data.

About Account Aggregator

The Account Aggregator (AA) empowers the individual with control over their personal financial data.

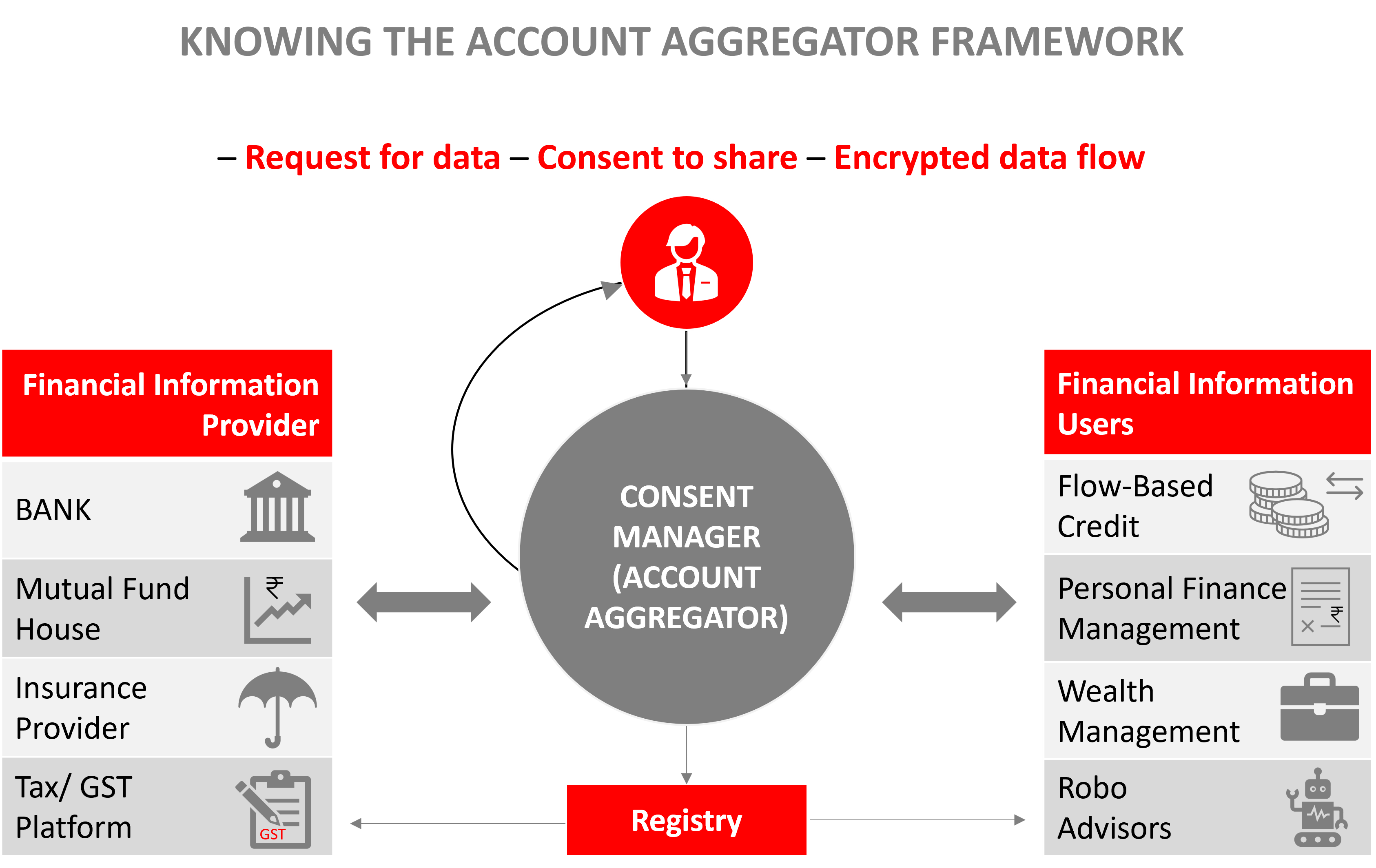

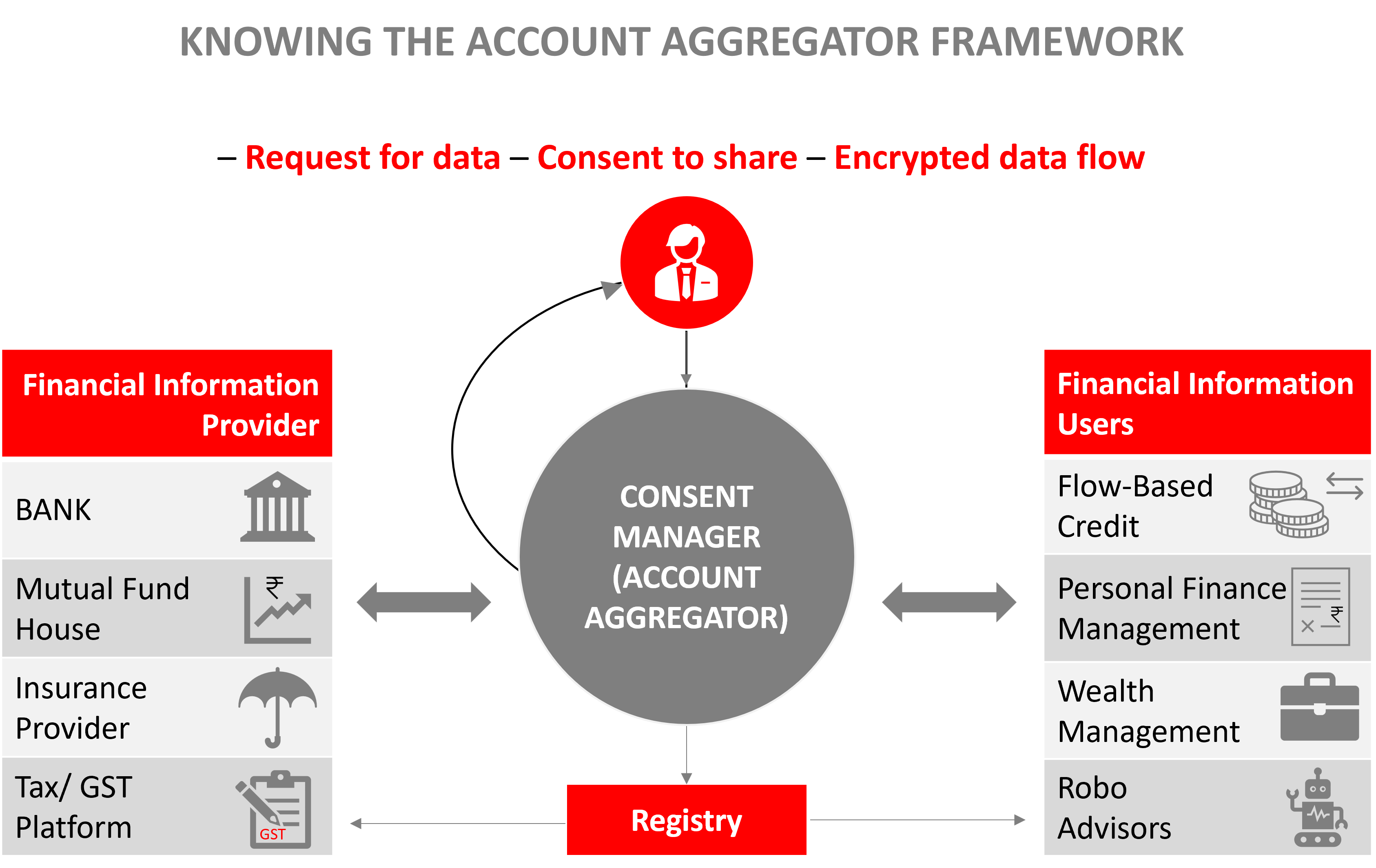

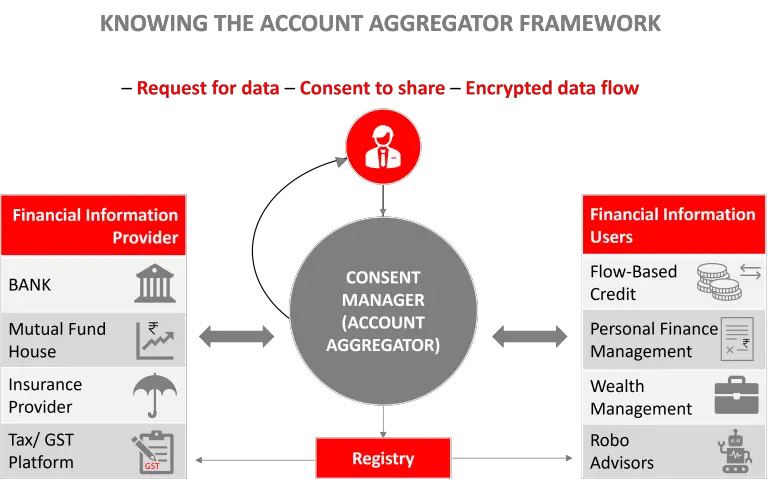

- An AA facilitates sharing of financial information in a real-time and data – blind encrypted manner between regulated entities (Banks and NBFCs)

- It enables’ flow of data between Financial Information Providers’ (FIPs) and Financial Information Users’ (FIUs)

- It is a type of RBI regulated entity (with an NBFC – AA License) that helps an individual securely and digitally access and share information from one financial institution they have an account with to any other regulated financial institution in the AA network. However, the data shall not be shared without the consent of an individual.

- The RBI in 2016 approved AA as a new class of NBFC, whose primary responsibility is to facilitate the transfer of user’s financial data with their explicit consent.

Impact of Account Aggregator on the common man’s life

Indian Financial system involves many processes for consumers today – sharing of physical signed and scanned copies of bank statements, running around to notariz e and stamp documents or to share personal username and password to give your financial history to third party. The AA network would replace all these with a simple, mobile based and safe digital data access & sharing process.

e and stamp documents or to share personal username and password to give your financial history to third party. The AA network would replace all these with a simple, mobile based and safe digital data access & sharing process.

The Individual’s bank only needs to be connected to the AA Network. AA system in banking has been launched with the eight largest banks in India, four are already sharing data on a consent basis (Axis, ICICI, HDFC and IndusInd Bank) and four are going to be enabled soon (SBI, Kotak Mahindra Bank, IDFC First Bank and Federal Bank).

Type of Data that can be Shared

Read more: https://www.acquisory.com/ArticleDetails/87/Knowing-All-About-Account-Aggregator-Network