In the dynamic world of finance, where complexities are the norm and risks abound, the demand for skilled professionals who can navigate these challenges is ever-growing. This is where financial engineering comes into play, offering a specialized set of tools and techniques to analyze, manage, and optimize financial risk.

Understanding Financial Engineering

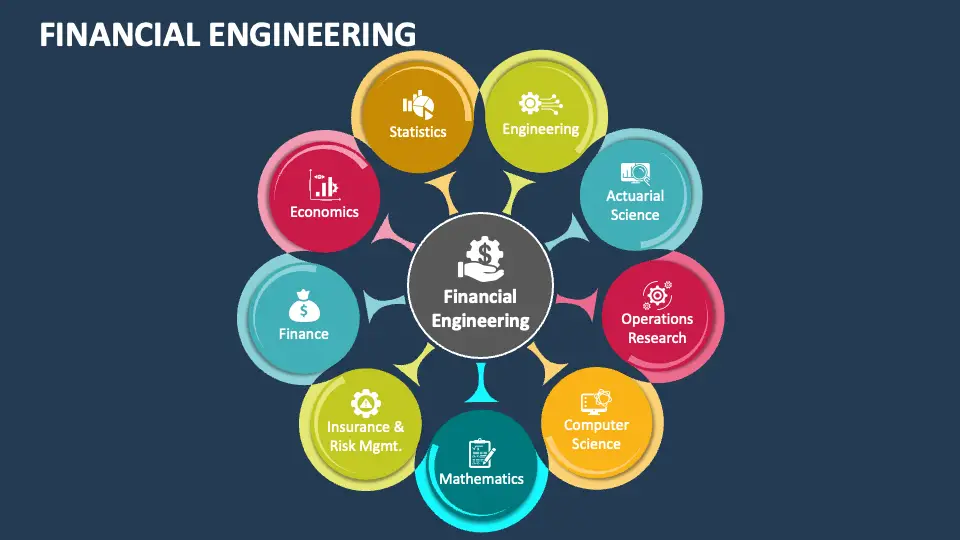

Financial engineering is a multidisciplinary field that combines principles from finance, mathematics, statistics, computer science, and economics. Its primary objective is to create innovative solutions for managing financial risk and maximizing returns. By leveraging mathematical models, algorithms, and computational techniques, financial engineers develop strategies for trading, investment, risk assessment, and portfolio management.

Financial Engineering Program: Curriculum Overview

A typical financial engineering program encompasses a broad range of topics designed to equip students with the necessary skills and knowledge to excel in the field. The curriculum often includes courses in quantitative methods, financial markets, derivatives pricing, stochastic calculus, risk management, and programming languages such as Python and R. Additionally, students may have the opportunity to specialize in areas such as algorithmic trading, computational finance, or quantitative portfolio management.

Benefits of Pursuing a Financial Engineering Program

Specialized Skillset: A financial engineering program provides students with a specialized skill set that is highly sought after in the finance industry. Graduates are equipped with quantitative skills, analytical thinking, and problem-solving abilities that are essential for success in roles such as quantitative analyst, risk manager, or financial engineer.

Career Opportunities: The demand for financial engineering professionals continues to rise, driven by the increasing complexity of financial markets and the growing importance of risk management. Graduates of financial engineering programs have access to a wide range of career opportunities in investment banks, hedge funds, asset management firms, and financial technology companies.

Competitive Salaries: Due to their specialized expertise, financial engineers command competitive salaries in the job market. According to recent surveys, professionals in this field often earn above-average salaries compared to their counterparts in other areas of finance.

Innovation and Research: Financial engineering programs foster innovation and research in the field of finance. Students have the opportunity to work on cutting-edge projects, develop new financial models, and contribute to advancements in quantitative finance.

Challenges and Considerations

While pursuing a financial engineering program offers numerous benefits, it also comes with its own set of challenges and considerations. The curriculum can be rigorous and demanding, requiring strong mathematical aptitude and programming skills. Additionally, the field of financial engineering is constantly evolving, meaning that professionals must stay abreast of the latest developments and trends to remain competitive.

Conclusion

In conclusion, a financial engineering program offers a unique opportunity for individuals looking to pursue a career in finance. With its emphasis on quantitative analysis, risk management, and innovation, it equips students with the skills and knowledge needed to thrive in today's dynamic financial landscape. Whether you're interested in algorithmic trading, or quantitative research, a financial engineering program provides a solid foundation for success in the field.