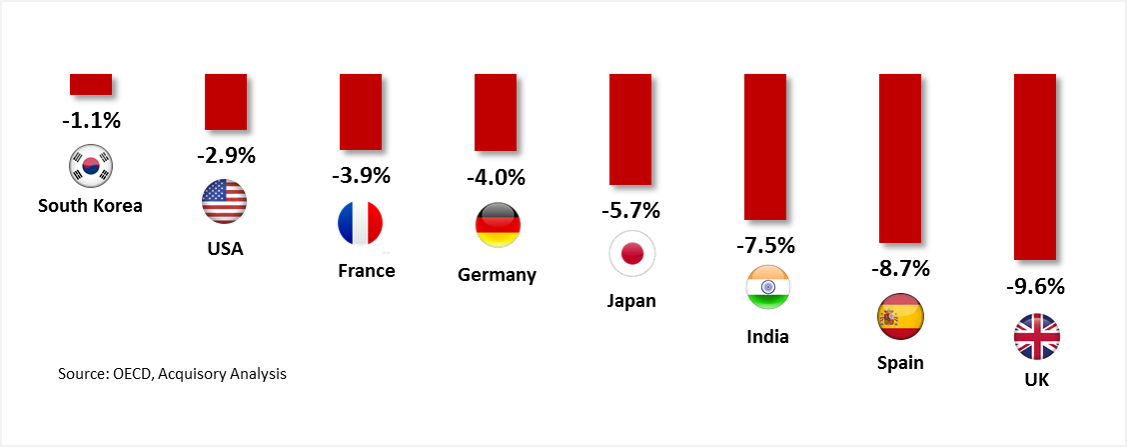

Empirically, stock market performance and broad macroeconomic trends have had a strong positive correlation. A couple of notable examples include the market crash of the 1930s following the period of the great depression and the crash of 2008 following the contagion impact of the global financial crisis. In 2020, the onset of the COVID-19 pandemic unleashed a similar sell-off in the global stock markets as countries worldwide initiated complete lockdown programs that further tormented the economy and devasted many livelihoods. The prolonged global lockdown dragged the world economy into recession with many countries experiencing massive GDP contraction.

Coronavirus Slump – 2020 Q3 GDP growth in select countries (in %)

With such an economic outlook unfolding, the bear traders would have jumped the gun and extensively shorted the stock market. Much to their surprise, they witnessed a one of its kind bull rally that took the global stock markets to record high levels.

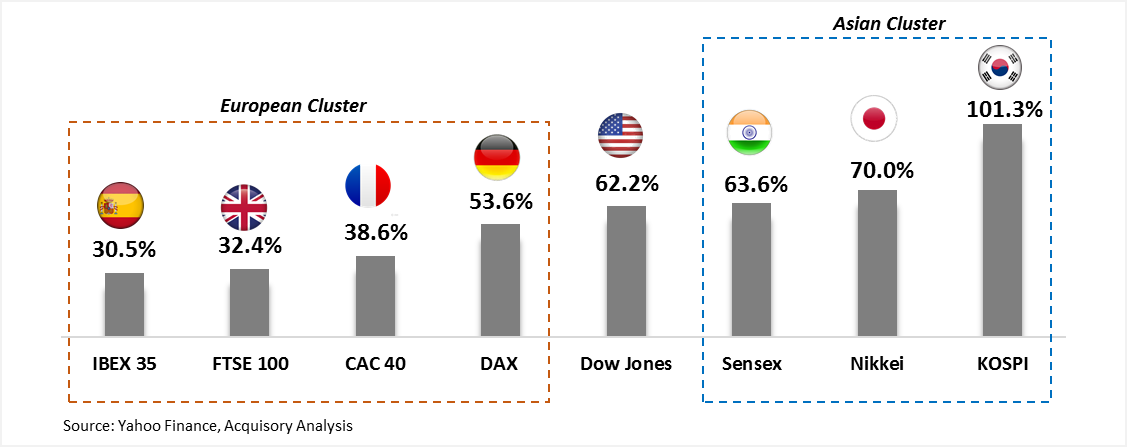

Increase in Global Stock Markets (in %) from Mar’20 to YTD

The global stock markets witnessed an influx of unprecedented buying with most of the global indices achieving record-high levels. Stock markets within the Asian cluster delivered superior performance compared to their European counterparts. Certain indices witnessed 100%+ growth within 9 months. Massive upswings are common in individual scripts, but to see trillion-dollar market capitalization indices deliver such high growth is an addition to the anomalies list of the stock market. It's evident that Macroeconomics doesn’t guide the markets rather its liquidity that sits on the driving seat.

What led to such unprecedented buying?

To shield the economy from the trickle-down effect of the pandemic-forced lockdown, global economies announced large-scale stimulus packages and ran budget deficits that…