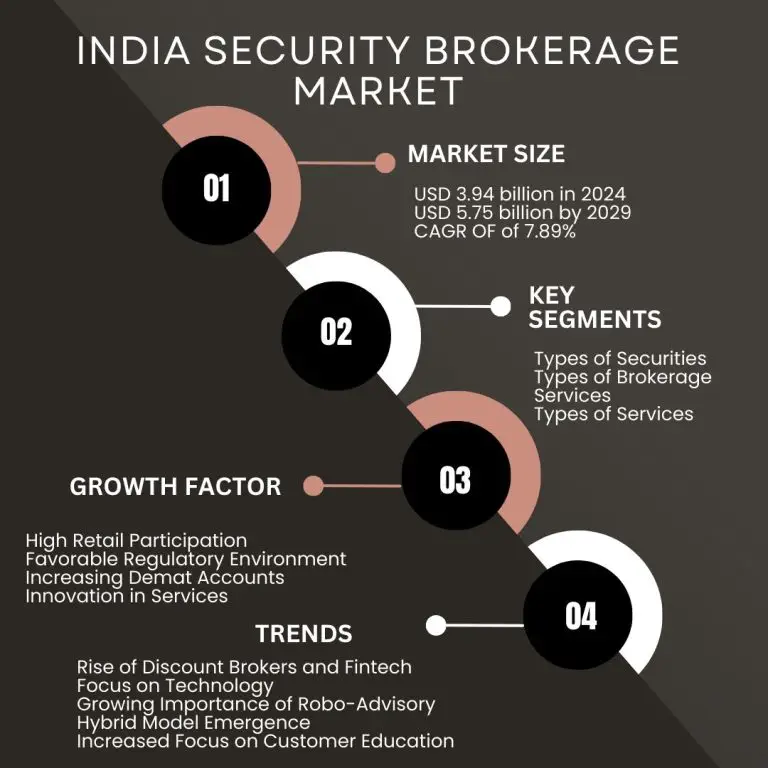

The India Security Brokerage Market size is estimated at USD 3.94 billion in 2024 and is expected to reach USD 5.75 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.89% during the forecast period(2024-2029). This significant growth is driven by a robust economy, increasing investor participation, and advancements in technology.

Key Segments of the India Security Brokerage Industry

The Indian Security Brokerage Market is a large and growing industry that offers a variety of services to investors.

Types of Securities

- Bonds: These are debt instruments issued by companies or governments. When you buy a bond, you're essentially loaning money to the issuer in exchange for a fixed interest rate over a set period.

- Stocks: Also known as shares, these represent ownership in a company. When you buy stock, you're buying a piece of the company and hoping its value will increase over time.

- Treasury Notes: These are debt instruments issued by the Indian government. They are generally considered to be a safe investment because they are backed by the government's full faith and credit.

- Derivatives: These are contracts that derive their value from an underlying asset, such as a stock, bond, commodity, or currency. Derivatives can be used to hedge other investments or to speculate on the movement of prices.

Types of Brokerage Services

- Stock Broking: This is the most common type of brokerage service, and it involves buying and selling securities on behalf of clients.

- Insurance Broking: Insurance brokers help clients find and compare insurance policies from different providers.

- Mortgage Broking: Mortgage brokers help clients find and apply for mortgages.

- Real Estate Broking: Real estate brokers help clients buy and sell real estate.

- Forex Broking: Forex brokers help clients buy and sell foreign currency.

- Leasing Broking: Leasing brokers help clients find and secure leases for equipment or property.

Types of Services

- Full-Service Brokers: These brokers provide a wide range of services, including investment advice, research reports, and portfolio management. They typically charge higher commissions than other types of brokers.

- Discount Brokers: These brokers offer a more basic level of service, but they also charge lower commissions. Discount brokers are a good option for investors who are comfortable making their own investment decisions.

- Online Brokers: Online brokers allow investors to buy and sell securities online. They typically offer the lowest commissions, but they may not provide the same level of service as full-service brokers.

- Robo-Advisors: Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios for clients. Robo-advisors are a good option for investors who want a low-cost, hands-off investment solution.

- Brokers-Dealers: Brokers-dealers are firms that can both buy and sell securities for their own account and on behalf of clients.

India Security Brokerage Market Growth Factor

- High Retail Participation: A growing young population with disposable income is entering the stock market, boosting investor activity.

- Favorable Regulatory Environment: Government policies encouraging financial inclusion and digitalization are making investments more accessible.

- Increasing Demat Accounts: The rise in demat accounts, which hold securities electronically, simplifies investment processes and attracts new investors.

- Technological Advancements: Online platforms and mobile apps provide user-friendly interfaces and lower transaction costs, making investing more convenient.

- Innovation in Services: Discount brokers and robo-advisors offer low-cost investment options, catering to a wider audience.

India Security Brokerage Industry Trends

The Indian Security Brokerage Market is not only growing but also undergoing some interesting trends.

- Rise of Discount Brokers and Fintech: Traditional full-service brokers are facing competition from discount brokers and fintech (financial technology) companies. These new players offer lower commissions, user-friendly online platforms, and mobile apps, making investing more accessible and affordable for retail investors.

- Focus on Technology: Technology is playing a major role in the market's growth. Brokerage firms are investing heavily in artificial intelligence (AI) and data analytics to provide personalized investment recommendations, research reports, and automated investment solutions.

- Growing Importance of Robo-Advisory: Robo-advisors, which are automated investment platforms, are gaining traction. They offer low-cost, algorithm-driven investment management, appealing to millennials and young investors who prefer a hands-off approach.

- Hybrid Model Emergence: As investors seek a balance between cost and service, a hybrid model is emerging. Brokers are offering a combination of full-service features like research and advisory services, alongside discount brokerage options.

- Increased Focus on Customer Education: With a growing number of new investors, there's a rising focus on financial literacy and investor education. Brokerage firms and financial institutions are offering educational resources and tools to help investors make informed investment decisions.

- Regulatory Influence: Regulations by the Securities and Exchange Board of India (SEBI) play a crucial role in shaping the market. SEBI's focus on investor protection, transparency, and digitalization will continue to influence how brokerage firms operate.

Major Players in the India Security Brokerage Sector

The Indian security brokerage market is a dynamic key player.

Discount Brokers

- Zerodha is one of the leading discount brokers in India, known for its low brokerage fees and user-friendly platform.

- Upstox is another prominent discount broker offering competitive rates and a focus on technology.

- Groww is a major discount broker that has emerged as a leader in terms of active client base. They are known for their investment in educational resources.

- 5paisa Capital is a discount broker known for its low account opening charges and flexible brokerage plans.

Full-Service Brokers

- ICICI Securities is a leading traditional broker offering a wide range of services, including research reports, portfolio management, and investment advice.

- Motilal Oswal Financial Services is another established full-service broker known for its in-depth research and market analysis.

- Angel Broking is a traditional broker that has adapted to the online space, offering a mix of online trading tools and personalized investment advice.

Other Important Players

- Sharekhan: Sharekhan is a prominent player offering a blend of discount and full-service brokerage along with wealth management solutions.

- India Infoline: India Infoline (IIFL) is a diversified financial services company with a brokerage arm offering online trading services and research.

Recent Market Developments

- Groww's Acquisition of Indiabulls Housing Finance Mutual Fund Business: In May 2023, Groww acquired a 100% stake in the mutual fund business of Indiabulls Housing Finance for INR 175.62 crores (USD 21.23 million). This acquisition aims to make mutual funds more accessible and transparent, besides lowering costs.

- Axis Bank's Acquisition of Citibank's Consumer Businesses: In March 2022, Axis Bank consolidated its position among large private lenders by acquiring Citibank's consumer businesses covering loans, credit cards, wealth management, and retail banking operations in India.

Conclusion

The India Security Brokerage Market is dynamic and influenced by a combination of economic, regulatory, technological, competitive, demographic, and global factors. Brokerage firms must adapt to market dynamics and meet client needs to thrive in this competitive landscape. By embracing new technologies, enhancing customer service, and staying updated with regulatory changes, brokerage firms can navigate the complexities of the market and achieve their business goals.