If you are preparing to tie the knot, then there is a fantastic chance it will not be economical.

If you are lucky, you might have sufficient savings to pay all of your wedding costs, or parents that are prepared to foot some or all the bills. Otherwise, you might end up at a crossroads: Can you take on debt to get your dream wedding, or would you cut with a smaller party?

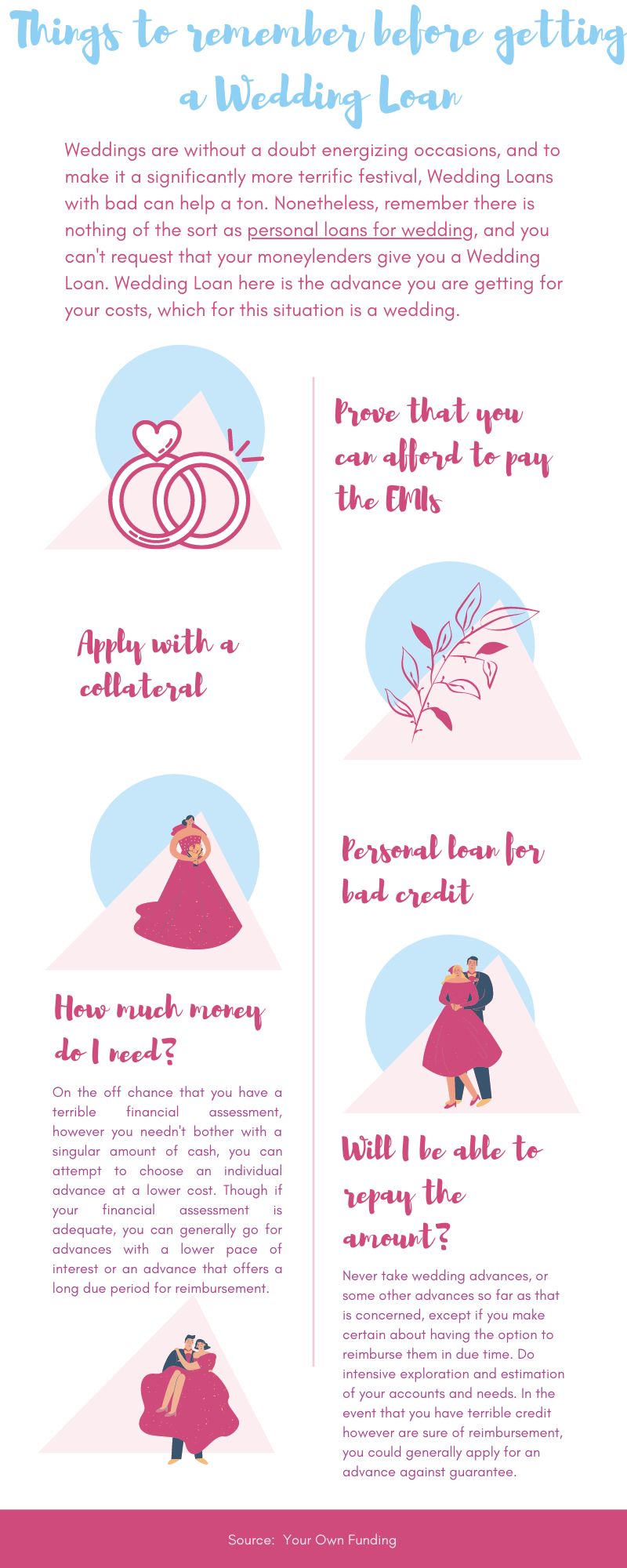

A marriage — that is merely a private loan which you use for marriage expenditures — or even a credit card may be viable choices, but only in the event that you're able to manage to pay off the debt in a reasonable time. You most likely don't need to begin your new union stuck in high school debt for a long time to come.

In case you really do need to fund your wedding, here is some useful information to think about using a credit card or taking out a private loan — that we will refer to as a marriage going forward. And if you are not opposed to scaling back into a wedding to avoid going into debt, then we've got hints for that, also.

What we're discussing here is having a private loan for the purpose of financing your marriage. Most financial advisors would let you stop and not pursue marriage loans. “The issue with private loans is that most often people are carrying them out since they are attempting to invest money they do not have. I'd also lump in credit card since I feel a good deal of individuals cover wedding-related items using a credit card and they might or might not have the money to pay it off in total.” Personal loans are great to prevent spiraling into credit card debt, but not as a fast fix for a deposit on your own venue. That having been said, taking loans for wedding financing is not unheard of, and there are a couple of ways to start obtaining a private loan to help pay for wedding expenses.

Would you take a loan out for your wedding? Provided that you're able to qualify for your loan, the solution is yes. The actual question is: if you take a private loan to your own wedding?

Benefits of Wedding Loans

- They are a convenient way to find the money. As you get started planning your wedding, you will discover your place and your sellers expect upfront deposits so as to reserve their space and solutions. These costs can accumulate quickly, particularly once you put in your wedding gown and accessories to the mixture. If you do not have a massive chunk of cash sitting around on your savings accounts, a union loan may give you the money you want to cover your own deposits.

- They are simple to get. Oftentimes, you are able to apply to your own wedding online in a matter of minutes as soon as you obtain your financial records in order. Your lender or loan provider will examine your program, and, in case you are accepted, will deposit your loan amount directly to your account.

- You will receive your money fast. Most creditors may review your application, accept it, and deposit your amount of the loan in a few days. Some lenders even assert loan financing in one day.

- In case you've got a fantastic credit score along with a solid credit history, odds are that you're able to find a marriage loan with a rate lower than your credit cards.

- Some loans do not bill for prepayments. Some loans allow you to repay your loan early with no charge fees, which may help save you on interest expenses. If you're planning on repaying your loan with money gifts from wedding guests, or if parents or other household members have provided to help finance your Big Day, then you might not need to pay any attention in any way. Double-check the terminology of your loan to be certain prepayments are permitted.

- You will improve your credit rating. Couples seeking to develop or increase their credit may boost their rating by paying their union loan. A higher credit rating will make it much easier to get loans in the future and also maintain your interest rates.

Is the wedding right for me?

Being a server in your wedding usually means a whole lot of responsibilities within your mind. Sometimes, when you find a union loan to have an excellent wedding, you've got yet another added responsibility in your mind, i.e. to refund your loan in the not too distant future, right?

Therefore, you may often wonder whether the wedding is a fantastic alternative for you.

For this, you will need to understand that unless and until you're secure enough efficiently to fund your wedding by yourself, you shouldn't be going to get financing in any way.

Apply for wedding financing today!