Virtually every industry continues to digitalize, creating new opportunities for businesses to grow and for consumers to enjoy unprecedented access to goods and services. But new and expanding digital platforms also present fresh targets for fraud rings, bot attacks, and other online threats.

Everyone is at risk, from individual shoppers to well-established financial institutions. Simply put, today’s digital fraudsters are cunning and relentless. Organizations and private citizens alike are investing in new tools to detect fraud in real time and stop it at the point of attack. As you consider how to bolster your digital defenses, you might also be trying to identify trends that indicate how fraud will evolve throughout the rest of the year.

Here’s a look at a few trends you can expect to see in the digital space in 2023. With this information you can better defend yourself and your organization against bad actors.

Economic Downturn Drives Fraud Growth

Recession or not, many people can find themselves in a tight economic situation for one reason or another. Maybe their hours were cut without explanation, their employer was forced to close the business, or their position was eliminated. When these scenarios occur, some people are tempted to turn to fraud as a way to make money, and some even become career criminals.

Should some predictions about the global economy prove correct in 2023, we could see economies shrink and unemployment rates rise. In turn, we can likely expect to see growth in the already burgeoning fraud industry.

Fraudsters Will Use Bot Attacks to Target PII

Digital bad actors, such as members of fraud rings, commonly use compromised PII to commit new account opening fraud and take advantage of inadequately defended companies. Insurers, fintech companies, and many others are all at risk if they depend solely on PII-based systems for identity verification and fraud detection. The bad guys know this, which is why they’re constantly searching for access to PII. Whether it comes from data breaches, phishing schemes, or other sources, they’ll take any information they can get.

Fraudsters have long employed bot attacks and malware to steal PII, but these tools have become even more accessible in recent years. Just as a manufacturer might seek to bolster their bottom line by realizing new efficiencies in their processes, fraudsters can get more done by automating their attacks or utilizing tools that allow them to work faster than they could otherwise.

Further Adoption of Behavioral Analytics

The abuse of stolen PII isn’t new, and there are organizations that play a pivotal role in fighting fraud. They’ve worked to evolve their tools and methods over the years. Companies that want to stay a step ahead of fraudsters are constantly innovating and embracing the latest technology. At the forefront of today’s fight against fraud is behavioral analytics software.

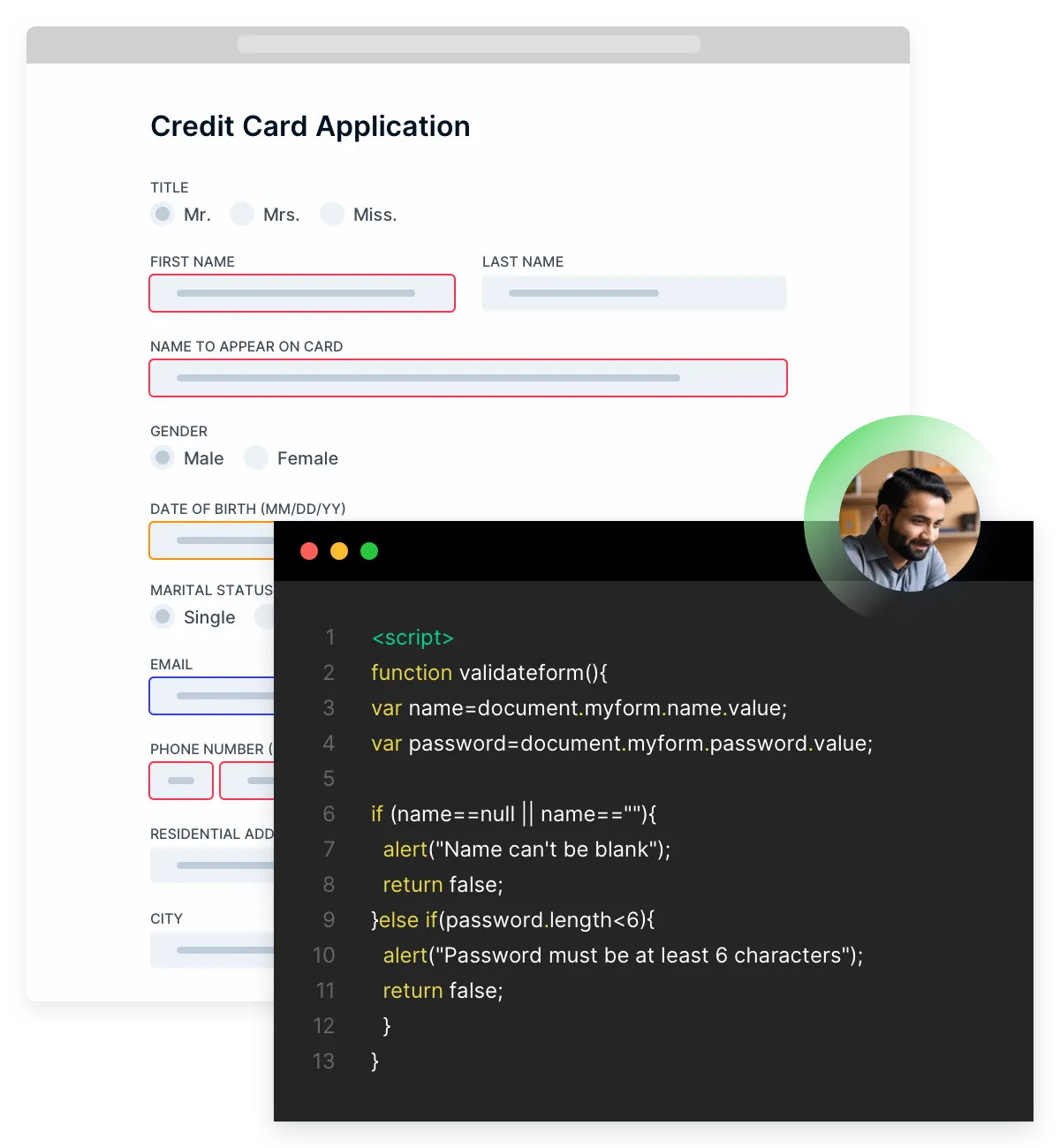

Not familiar with behavioral analytics? This powerful technology reads the digital body language of your site users. As they interact with your site forms, behavioral analytics tools observe your users’ actions, looking for indications that a user is unfamiliar with their PII—a likely indicator of fraudulent intent. These tools can then flag risky users in real time, so your step-up verification measures can intervene and stop fraudsters before they make it too far.

Fraudsters are as sophisticated as ever, and they have a knack for masking their identity and intent. But they can’t hide their digital body language, which is why more organizations trust behavioral analytics tools to help take their fraud detection strategy to the next level.

About NeuroID

With compromised PII and devious strategies like synthetic identities at their disposal, digital fraudsters are more cunning and aggressive than ever before. That’s why leadership teams are turning to NeuroID for a proactive approach to fraud detection that leverages cutting-edge technology. That way, you can catch would-be fraudsters at the point of attack. Instead of relying on PII to verify identity, NeuroID harnesses the power of behavioral analytics, passively monitoring every user’s taps, swipes, and keystrokes as they interact with your site forms in real time. By reading the digital body language of each user to spot risky activity, NeuroID delivers superior ID verification based on behavior to help your organization stay ahead of fraud activity.

Stay ahead of fraud with behavioral intelligence tools from NeuroID at https://www.neuro-id.com/

Original Source https://bit.ly/3YOtNhb