The wide array of hazards across the digital landscape is enough to make anyone wish for the commerce standards of yesteryear. When a potential customer walked up to the counter or sat across from a lender, you could get an idea of who they were and how they operated. Moreover, they had to produce personal documentation such as a driver’s license, social security card, or utility bill to prove their identity. These were simpler times. The modern online marketplace is far less certain. In fact, the persistence of bad actors, the wide availability of compromised personal information, and the eroding effectiveness of fraud detection systems have led to a digital identity crisis that causes untold harm each year. Here, you’ll learn more about this crisis and which industries face the most substantial threats.

Online Lenders

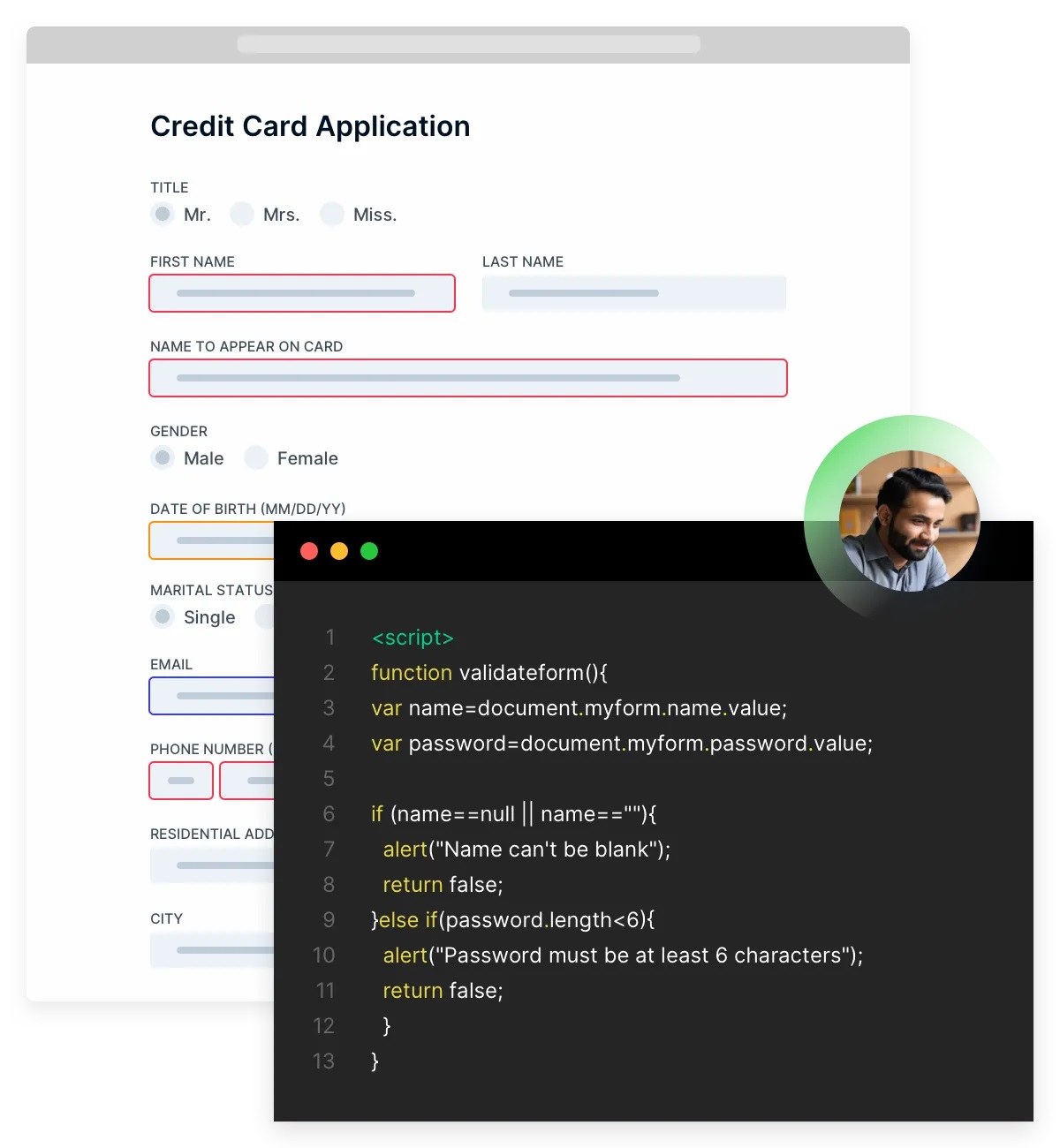

The ability to issue credit cards or otherwise lend to consumers online is more than good for business—it’s contributed to the boom of the entire global economy. It’s difficult to imagine what our world might look like without online lending. And while modern lending looks much different than it once did, it still depends on a single principle: trust. That’s precisely why the digital identity crisis is so real for online lenders. How do you trust that someone is who they say they are, especially when so many people use stolen and synthetic identities to commit new account fraud daily?

Insurance

As if the unique challenges of handling relief funding weren’t enough for insurers, they must also contend with increased new account fraud. In recent years, digital fraud attempts have grown immensely, with more fraud attempts occurring in the insurance industry than any other. It’s not just fraudulent claims, although those are a big part of the problem. It’s also the fundamental complication of the digital identity crisis: Stolen personal information makes it easy for fraudsters to open new accounts by posing as someone else or forging fictitious identities that seem real enough to aging identity verification systems.

Healthcare

The term “identity theft” likely conjures thoughts of credit cards, fraudulent charges, and even home title fraud. Many people don’t think of medical identity theft as a significant problem in the world of digital fraud, but it can produce severe consequences. If a bad actor uses stolen or compromised PII to submit fraudulent Medicare claims, for example, this can lead to disrupted care and exorbitant costs. More than ever, healthcare companies must protect themselves and their patients with dynamic ID verification tools.

Retail

The retail sector is uniquely exposed to a variety of fraudulent activities, both online and within brick-and-mortar locations. While return fraud and the abuse of e-gift cards are quite common, retailers shouldn’t overlook the potential damage of fake accounts. Fraud rings have been known to create dozens of accounts to abuse discount codes and resell items at a higher price. Because retail accounts are among the easiest to establish, business leaders in this sector should make an effort to educate themselves on the unique threats to retail companies and how to utilize identity orchestration tools for real-time fraud detection.

About NeuroID

It’s a simple fact of doing business online: Bad actors are always sizing up digital defenses and devising new strategies for taking advantage of vulnerable organizations. Fraudsters develop increasingly sophisticated methods of posing as genuine customers to slip past old PII-based detection systems and target your company. But with the power of behavioral analytics tools from NeuroID, you can seize the initiative and detect fraud indicators before criminals have a chance to cheat you. The groundbreaking technology in their ID Crowd Alert™ and ID Orchestrator™ tools analyzes digital body language and pre-submit data to spot risky activity in real time. With the ability to detect fraud rapidly, your step-up verification systems can intervene and effectively protect your organization.

Modernize your organization’s fraud detection tools with NeuroID at https://www.neuro-id.com/

Original Source: https://bit.ly/3y1zlJW