Disclaimer: This is a user generated content submitted by a member of the WriteUpCafe Community. The views and writings here reflect that of the author and not of WriteUpCafe. If you have any complaints regarding this post kindly report it to us.

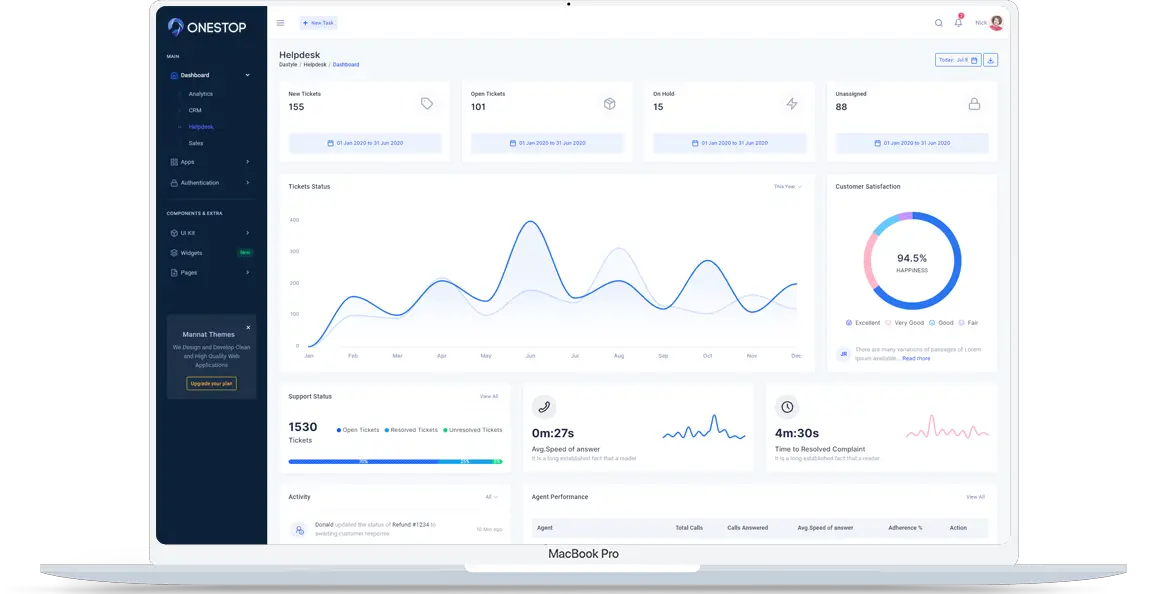

Proper financial management is critical for attaining long-term success and sustainable growth in today's fast-paced startup market. This enlightening blog explores the remarkable advantages of Onestop GST enabled online accounting software for startups, empowering them to streamline operations, make informed decisions, and optimize their financial health.

Lets discover how embracing Onestop accounting & invoicing software can propel your startup toward new heights.

- Automate your bookkeeping

-

-

- Save time by automating tasks such as data entry, invoicing, and expense tracking.

- Reduce errors and improve the accuracy of financial records.

- Generate professional invoices and track payments.

- Provide insights through robust reporting and analysis.

- Integration with other systems enhances efficiency and reduces manual data entry.

- Simplify bookkeeping processes and improve financial management for businesses.

-

- Improve your cash flow management

-

-

- Track income and expenses in real-time.

- Monitor cash flow regularly to identify potential issues.

- Set up automated invoicing and payment reminders.

- Categorize expenses accurately to gain insights into spending patterns.

- Use cash flow forecasting features to project future cash flow.

- Automate bank reconciliation to maintain accurate financial records.

- Generate cash flow reports to analyze trends and make informed decisions.

- Integrate payment processors for streamlined payment collection.

- Take proactive measures to address cash flow issues and improve financial stability.

-

- Helps you make better business decisions

-

-

- Access financial data and reports for insights into business performance.

- Analyze key financial metrics to understand the financial health of your business.

- Identify trends and patterns in financial data for improvement opportunities.

- Evaluate the profitability of products or services.

- Monitor performance of specific projects or departments.

- Compare financial data over different periods for growth assessment.

- Use financial insights for resource allocation and investment decisions.

- Identify areas where costs can be reduced or efficiencies can be improved.

- Assess the financial impact of potential business decisions through forecasting.

- Share financial information with stakeholders to demonstrate stability and potential.

-

- Saves time

-

-

- Automate data entry and reduce errors.

- Streamline invoicing and set up recurring invoices.

- Automate bank reconciliation for accuracy.

- Track and categorize expenses efficiently.

- Generate financial reports automatically.

- Simplify tax preparation and filing processes.

- Collaborate efficiently with multiple users.

- Integrate with other tools to eliminate manual data entry.

- Access financial data in real-time from anywhere.

- Maintain compliance and organized record-keeping.

-

- Reduces errors

-

-

- Automate bookkeeping tasks to minimize errors.

- Stay compliant with tax laws and regulations.

- Helps you gain peace of mind and focus on business growth.

- Impress investors by demonstrating financial order.

- Minimize manual input errors.

- Ensure accurate calculations.

- Benefit from error-checking features.

- Automate reconciliation to prevent errors.

- Track and correct errors efficiently.

- Maintain an audit trail for error identification.

- Validate data in real-time for error prevention.

- Generate error-free financial reports.

-

- Helps you stay compliant

-

-

- Ensure compliance with tax laws and regulations.

- Minimize the risk of errors and non-compliance.

- Stay organized with proper document management.

- Receive timely reminders for tax deadlines.

- Track deductible expenses and maximize deductions.

- Generate necessary reports for tax filing.

- Utilize built-in compliance checks.

- Simplify tax preparation and filing processes.

- Maintain an audit trail for transparency.

- Stay up-to-date with tax regulations.

- Minimize stress and potential financial burden.

-

- Attract investors

-

-

- Enhance investor confidence with financial transparency.

- Provide accurate financial statements for insights.

- Keep investors informed through timely reporting.

- Facilitate efficient investment analysis.

- Project a professional image and attention to detail.

- Enable easy access to financial information.

- Ensure compliance with regulations.

- Streamline communication with investors.

- Highlight scalability and growth potential.

- Demonstrate effective risk management.

-

- Improve your credit score

-

-

- Track income and expenses to manage financial health.

- Make timely payments for a positive credit history.

- Monitor credit utilization to optimize credit score.

- Identify and address potential credit issues.

- Demonstrate responsible financial management.

- Increase creditworthiness for loan approvals.

- Build a strong credit profile.

- Access better interest rates.

- Enhance financial stability and flexibility.

-

- Grow your business

-

-

- Gain financial insights for informed decisions.

- Allocate resources effectively.

- Identify profitable products or services.

- Track key performance indicators.

- Optimize pricing strategies.

- Monitor cash flow for sustainability.

- Identify cost-saving opportunities.

- Plan for expansion and investment.

- Maximize revenue and minimize expenses.

-

- Save money

-

-

- Automate time-consuming tasks for efficiency.

- Reduce errors and avoid costly mistakes.

- Stay compliant with tax laws.

- Streamline financial processes.

- Track expenses and identify cost-saving opportunities.

- Optimize cash flow management.

- Generate accurate financial reports.

- Simplify tax preparation.

- Avoid financial penalties and fines.

- Maximize profitability.

-

- Get peace of mind

-

- Ensure accurate financial records and statements.

- Eliminate the stress of manual bookkeeping.

- Monitor and track financial health in real-time.

- Safeguard against financial errors and discrepancies.

- Easily access and retrieve financial information.

- Stay organized with centralized financial data.

- Minimize the risk of financial mismanagement.

- Have confidence in making informed decisions.

- Reduce anxiety by staying on top of financial obligations.

- Focus on business growth and strategic initiatives.

If you're a startup, OneStop accounting software is a valuable tool that can help you save time, money, and headaches. There are many different cloud based accounting software programs available, so be sure to compare features and prices before you choose one.