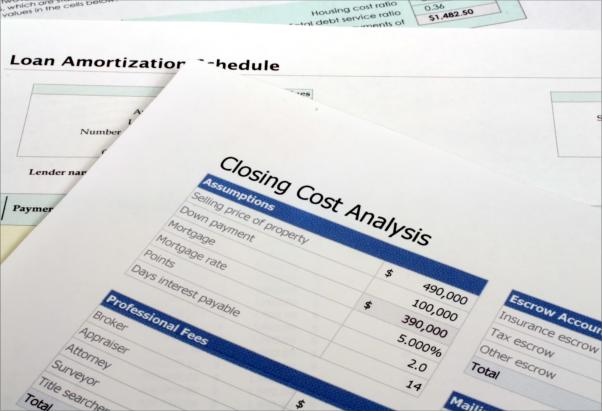

Are you confused about the closing costs Ottawa Ontario while buying or selling a house? There may be several costs such as attorney’s fees, land transfer fees, insurance fees, mortgage charges, inspection charges, and more associated with property dealings. Before making the deal, buyers need to consider all these costs as this would add up along with the actual price of the property.

Major factors that affect closing costs Ottawa Ontario

- Value of property

- Location of property

- First home buyer or not

- Property is being financed or mortgaged

In this post, we’ll discuss about the most popular closing costs Ottawa Ontario that need to be considered by the buyers when considering purchasing a property. Usually, home buyers should keep aside 2%-5% of the total property costs for such additional services for closing costs in Ontario.

Home inspection

Most of the homeowners neglect home inspection and regret that later on. What would you do if you move into your new house and find leaking taps? Or broken window panes? Or your attic may need repair? It may be frustrating for the homeowners to find such problems in the house when they move in. Hiring experts for home inspection can help you get complete peace of mind and it would ensure that all issues are sorted before you shift to your new home.

Real estate lawyer fees

You may need help with legal documentation and contract. So, hiring real estate lawyer is a good idea to make the transaction smooth and hassle-free. Consider real estate lawyer fees while determining closing costs Ottawa Ontario.

Land transfer fees

All the properties bought in Ontario need to pay land transfer fees as this is the tax charged by the government when a deed is registered. Consider the land transfer fees when estimating closing costs for home in Ottawa.

Title Insurance

Title Insurance protects the buyers against any type of defect in the title of the property. It helps the homeowners stay protected against several risks including fraud and forgery.

Real estate commissions

If you are hiring real estate agents for helping you search the right property matching your requirements and budget, you can consider the costs associated with it.

Moving costs

Moving all your belongings and furniture to your new home will also cost you additional money. You may need to hire professional movers for the job. Vendors would charge you extra money for moving your stuff from one place to another.

Consider all the factors and jot down everything that is required when you need to purchase a house. List down everything along with the costs so that you know the actual price of the property.