In today's digital age, insurance companies are increasingly turning to mobile apps to enhance customer engagement, streamline processes, and stay competitive in the market. Developing an insurance mobile app requires careful planning and execution to ensure that it meets the needs of both customers and insurance providers. In this guide, we'll explore the essential steps and considerations for developing a successful insurance mobile app.

01. Define Your Objectives and Target Audience

Before you start developing your insurance mobile app, it's crucial to define your objectives and target audience. Determine the specific features and functionalities that will appeal to your target users, such as policyholders, agents, or claims adjusters. Understanding your audience will help you tailor your app to meet their needs effectively.

2. Conduct Market Research

Conduct thorough market research to understand the competitive landscape and identify potential opportunities for your app. Analyze existing insurance mobile apps to identify their strengths and weaknesses, which can help you differentiate your app in the market.

3. Choose the Right Features

Based on your research and understanding of the market, determine the key features that your insurance mobile app should offer. Some essential features of an insurance mobile app include:

– Policy management: View, update, and renew policies

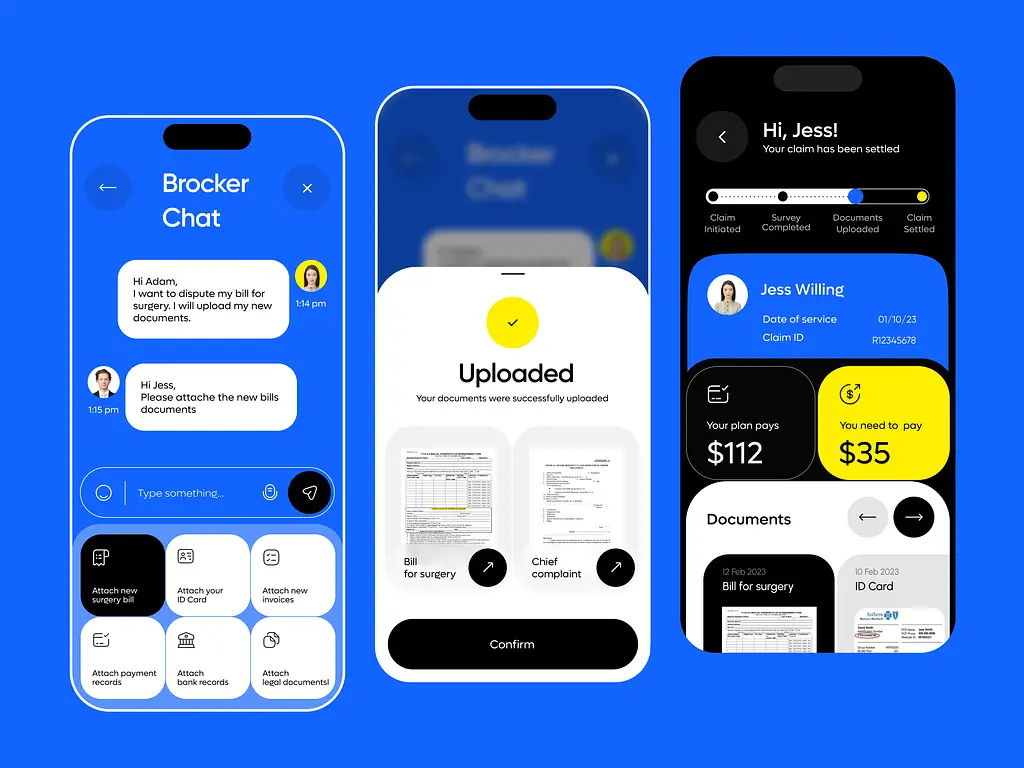

– Claims processing: Submit and track claims

– Insurance quotes: Get quotes for new policies

– Digital insurance cards: Access and store insurance cards digitally

– Payment processing: Pay premiums and view payment history

– Document upload: Upload and store documents related to policies

– Customer support: Chat with agents or customer service representatives

Also Check: A Complete Guide to Neobanking App Development

4. Design the User Interface

Design an intuitive and user-friendly interface for your insurance mobile app. Consider using a clean and modern design that makes it easy for users to navigate and access the features they need. Pay special attention to the security features and ensure that they are easily accessible and understandable for users.

5. Choose the Right Technology Stack

Selecting the right technology stack is essential for the development of your insurance mobile app. Consider factors such as scalability, security, and performance when choosing your technology stack. Some popular technologies used for insurance mobile apps include:

– Frontend: React Native, Flutter, or native iOS/Android development

– Backend: Node.js, Python, or Java

– Database: MongoDB, PostgreSQL, or MySQL

6. Develop and Test Your App

Once you have defined your objectives, chosen the right features, and selected your technology stack, it's time to develop and test your app. You also can consider hiring app developers in india to develop your dream application. Work closely with your development team to ensure that the app is developed according to your requirements and meets the highest standards of security and performance. Conduct thorough testing to identify and fix any bugs or issues before launching your app.

7. Launch and Promote Your App

After successfully developing and testing your insurance mobile app, it's time to launch it in the market. Develop a comprehensive marketing strategy to promote your app and attract users. Consider leveraging social media, insurance industry influencers, and online communities to promote your app and reach your target audience effectively.

8. Gather Feedback and Iterate

Once your app is live, gather feedback from users to identify areas for improvement. Use this feedback to iterate and enhance your app, adding new features and improving existing ones to provide a better user experience. Continuously updating and improving your app will help you stay competitive in the insurance industry and meet the evolving needs of your customers.

Conclusion

Developing an insurance mobile app can be a complex process, you must find best fintech app development company. but by following the steps outlined in this guide and leveraging the right technology and features, you can create a successful app that enhances customer engagement and streamlines insurance processes. Remember to stay updated with the latest industry trends and regulations to ensure that your app remains relevant and compliant. With careful planning and execution, you can develop an insurance mobile app that meets the needs of your customers and helps your business thrive in the digital age.