Every individual behaves predominantly based on his or her concepts of lifestyle. If these principles differ from normality, the person enters into conflict with his friends but inevitably with the legal system. Despite the fact at the moment the average person is progressively instilled with freedom of behavior, this flexibility is sometimes misperceived. When for somebody independence signifies engaging in anything you want for private profit and benefit, for another individual it has the opposite significance. When we are speaking of legal rules, their main objective is usually to assist the person to keep the equilibrium as being a social being. Without maintaining an equilibrium, the entire society would turn into a chaos where everybody acts based on their very own rules. Consequently, laws and regulations exist for the good and advantage of the average person, even if it is from time to time challenging to comply with them. Whether we are now speaking about Code of Practice 9 or any other means by which the law intervenes to evaluate and correct specific inappropriate activities, the main reason for these is stated. As being a resident of your country, an individual that is part of community and last of all, as a reasonable person, man needs regulations and laws to enjoy protection and justice.

Once things are examined in general, misunderstandings or misconception can occur, considering that every person perceives diversely. Because the COP9 was already mentioned, it actually is appropriate to mention something regarding what this requires. The HMRC investigation team starts this inspection when it suspects really serious fiscal fraud. Anybody can commit that fraud, not just a firm but also a person. However, there is a huge difference between carrying out an unintentional scam and doing it intentionally. Certainly, in either circumstances we are dealing with disobeying the law, nevertheless the second circumstance is far more severe and plainly imposes a harder penalty. In aiming to avoid issues with legal requirements, the modern day individual has at his fingertips quite a few options to avoid it. Before everything else, whenever you are not aware of one thing, it is possible to request the assistance of people who have every piece of information regarding the particular field or activity in question. Therefore, when it comes to compliance with tax requirements, you can get advice on absolutely any issue you struggle with.

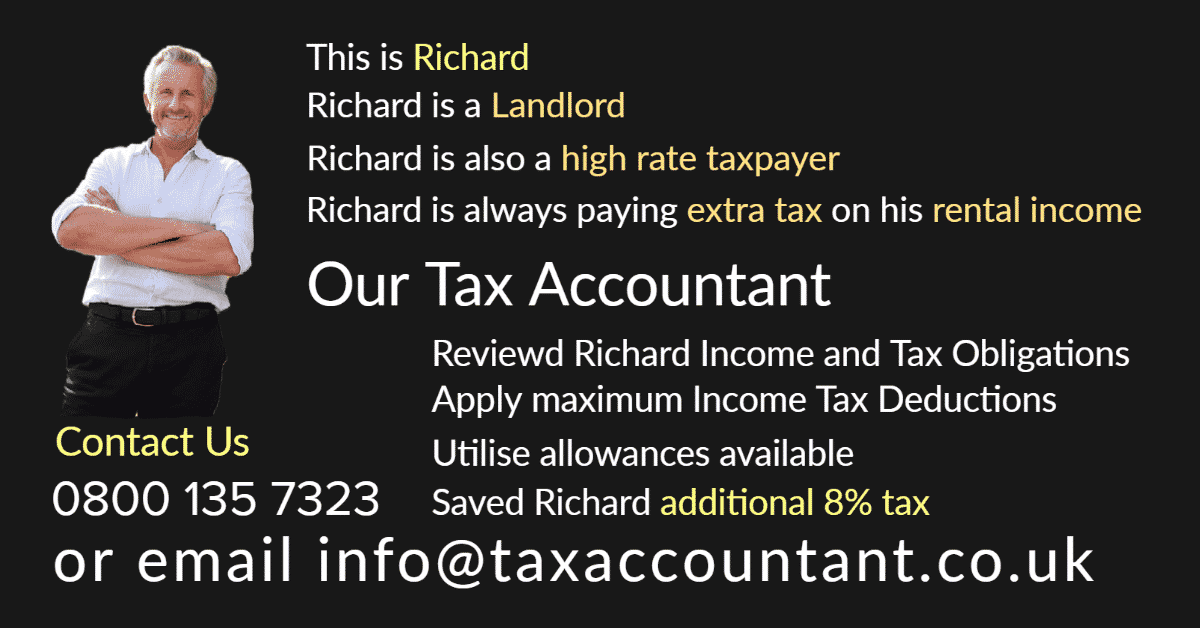

Today an educated individual usually means a strong person. So, since you are worried for more information regarding HMRC COP9 Inspection, pay a visit to taxaccountant.co.uk where exactly you will discover everything you need to understand about the laws and process in question.

For more details about COP9 just go to the best web portal

0