Investors and hedge funds are increasingly including alternate datasets into workflows to notify an investment decision-making procedure. Web data has constantly proven to be the most popular and influential. The demand for alternative data using web scraping is increasing because of its scale, availability, and a unique capability to produce alpha.

Web data is the No.1 source for alternative data, serving to inform the world’s finest asset managers about market opportunities and deploying them with needed insights to work quickly and create positions carefully. When scraping high-quality data online, there’s practically no limit to the quantity and type of data accessible.

In this blog, we’ll show different kinds of available web data for web scraping and how they could be used to update the investment decision-making procedure.

- Company News

- Product Data

- Product Reviews

- SEC Filing Data

- Sentiment Analysis

Company News

One can extract the web for frequencies of company news across different social media apps and business content providers, producing valuable data on the company’s trajectories.

High-level algo traders can incorporate this kind of data into procedures to ensure key news events are considered while making trades, and that’s the taste of possibility when this kind of data is included in the machinery investment.

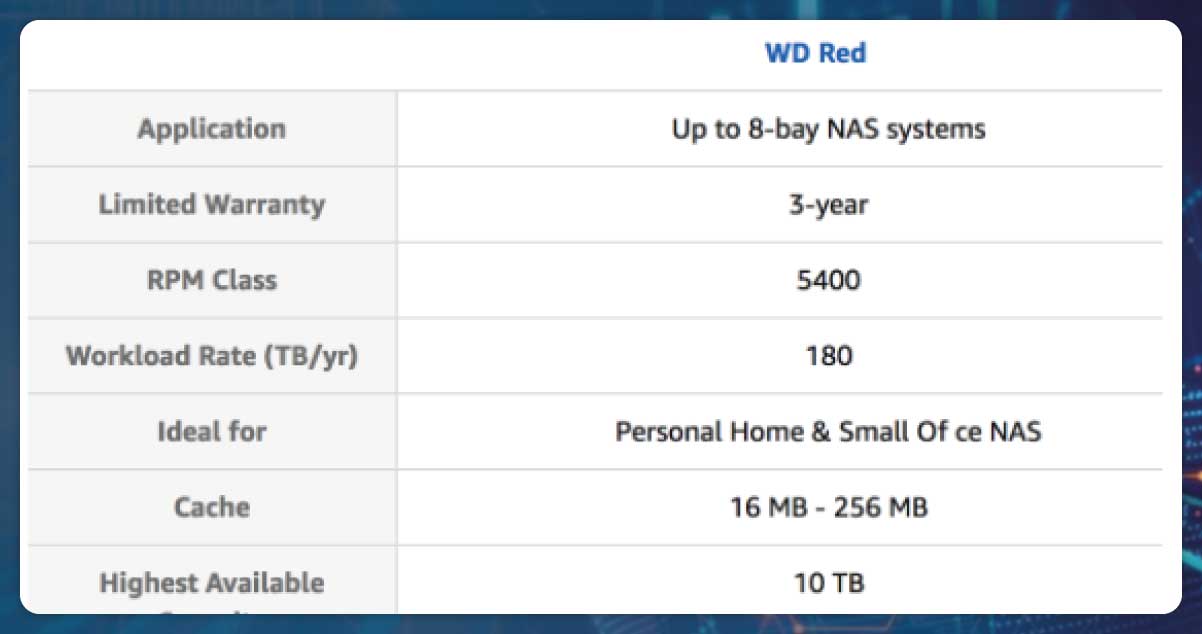

Product Data

Extracting product data from composite online marketplaces is a challenging task, but one offering tremendous insights into many factors essential for assessing stock performance and company fundamentals.

This data provides profitable opportunities for investors while determining positions and market orders and giving insights into long-term trends.

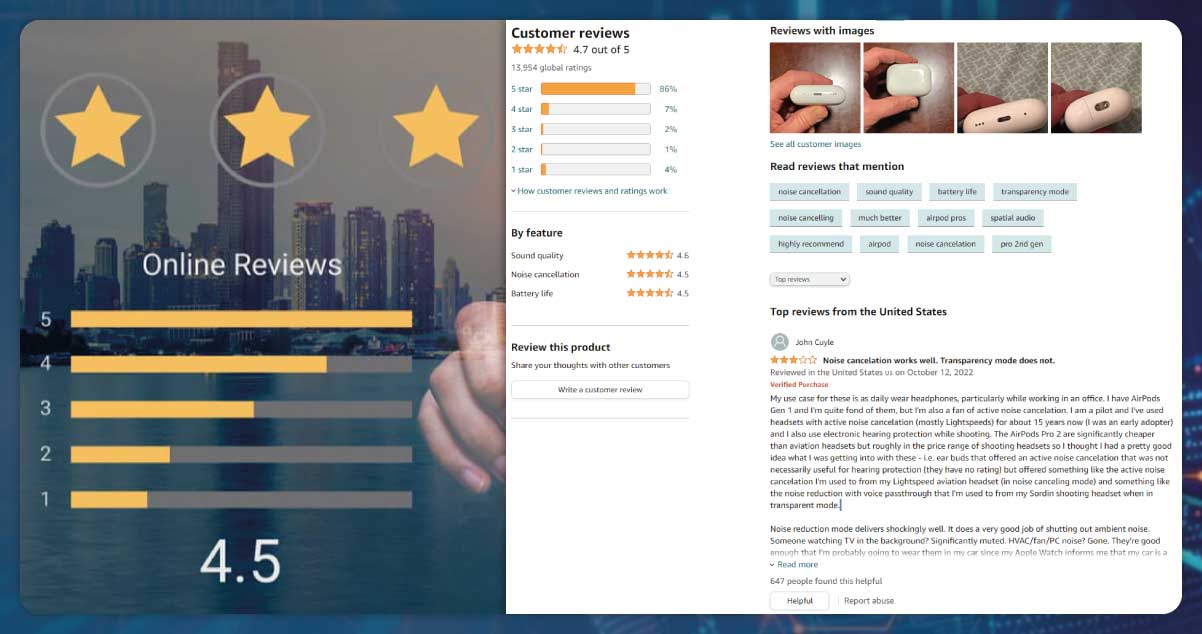

Product Reviews

To precisely guess how a stock will perform for a given company helps one understand how the essential products are trailing in a marketplace.

Tactlessly, the delay between quarterly earnings and company performance can check the usefulness of reports to do real-time analysis. Extracting product review data can help investors actively collect product life-cycle information and make updated assumptions about a company’s earnings.

SEC Scraping Data

Deep diving into lengthy and vague pages of companies’ SEC scraping can result in great investment insights. This gives investors reliable and high-quality information — data previously held per strict standards by the US government.

By extracting SEC data, the discovery procedure familiar to the investors could replicate tens of thousands of times with unlimited amounts of filings, finding valuable alpha in unseen places.

Sentiment Data

Some time ago, Bloomberg stated that access to Twitter stream provides among the most extensive and most beneficial alternative data sets for alpha-seeking investors, with newer developments in social economics research advising that “joint mood states resulting from big-scale Twitter feed” might expect Dow Jones movements having a fantastic accuracy of 87.6%!

By scraping sentiment data online, investors can make accurate and timely decisions in today’s ever-hastening market.

Contemporary data sources extend a wider variety, from those discussed to emailed receipts, geolocation data, and satellite imagery. The possibilities are endless, but sophisticated investors will get the finest results by merging human analytics, machine learning, and high-quality alternative data sets.

More and superior data means investment decision-making procedure consistently produces more value. Besides, adjusting to newer practices of alternative data ensures that your models are synced with the pending data-based change of virtually all business sectors.

Know more about web scraping for finance alternate data

At Actowiz Solutions, we have been in the scraping industry for many years. We have assisted in extracting web data for clients ranging from Fortune 100 companies and Government agencies to individuals and early-stage startups. With time, we have gained much expertise and experience in data extraction. For more information, contact Actowiz Solutions now! You can also reach us for your mobile app scraping and web scraping services requirements.

0