Market Dynamics

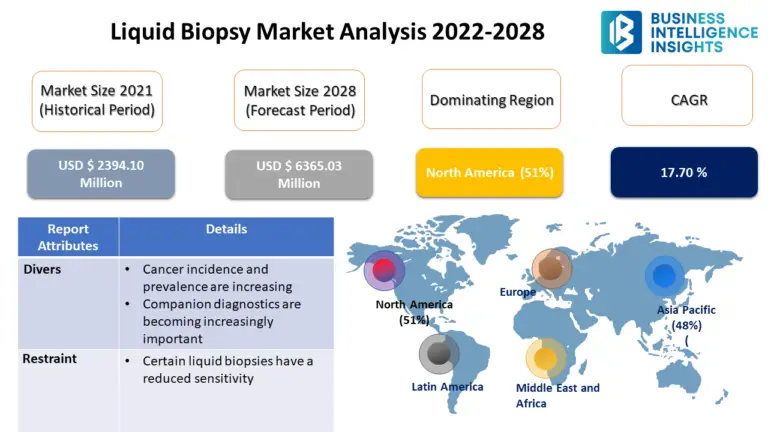

The liquid biopsy market is expanding as a result of advancements such as next-generation sequencing for advanced cancer patients in liquid biopsies, an increase in the number of cancer patients, and a rise in patient desire for less invasive therapy. However, lack of knowledge of liquid biopsy in developing regions restricts market expansion. On the contrary, increased healthcare spending in developing countries such as India and China, as well as the adoption of liquid biopsy testing to treat rare cancers, are expected to propel market expansion.

Liquid biopsy is a simple, quick, non-invasive, and repeatable sample process that can detect changes in tumour gene expression profiles and provide a solid foundation for individualised cancer treatment and early detection. Furthermore, early cancer screening, tumour progression tracking, assessing therapeutic response and clinical prognosis, and detecting recurrent and refractory malignancies have all received increased attention in recent years. Furthermore, liquid biopsy has recently received substantial interest as a non-invasive alternative to tissue biopsy in cancer patients due to technological breakthroughs in both practicality and turnaround time.

Revenue-generating Segment Highlights :

By Product & Service

- Assay Kits

- Instruments

- Services

By Circulating Biomarkers

- Circulating Tumor Cells

- Circulating Tumor DNA (ctDNA)

- Cell-free DNA (cfDNA)

- Extracellular Vesicles (EVS)

- Other Circulating Biomarkers

By Application

- Cancer Application

- Non-cancer Applications

By Technology

- Multi-gene Parallel Analysis using NGS

- Single-gene Analysis using PCR Microarrays

By Clinical Application

- Early Cancer Screening

- Therapy Selection

- Treatment Monitoring

- Recurrence Monitoring

By End User

- Reference Laboratories

- Hospitals and Physician Laboratories

- Academic & Research Centers

- Other End Users

By Region

- North America

o U.S.

o Canada

- Europe

o Germany

o U.K.

o France

o Italy

o Spain

o Rest of Europe

- Asia Pacific

o China

o India

o Japan

o Rest of Asia Pacific

- Latin America

o Brazil

o Mexico

o Rest of Latin America

- Middle East and Africa

o UAE

o South Africa

- Rest of Middle East and Africa (MEA)

Key Highlights of the report :

- Assay kit as a Product & Service led the Liquid Biopsy market in 2021. Assay kits have a market share of greater than 40%. Due to their regular purchase requirement, assay kits are a recurring expenditure, which is a major contributor to the segment's growth. The cancer burden is expected to rise significantly as a result of the adoption of western lifestyles and choices in economically developed countries, such as smoking, malnutrition, physical inactivity, and fewer births. The global market is expected to be driven forward by the desire for early cancer detection. Solid tissue and other disorders were diagnosed via liquid biopsy.

- Circulating Tumor Cells, Circulating Tumor DNA (ctDNA), Cell-free DNA (cfDNA), and Extracellular Vesicles are Circulating Biomarkers for which Liquid Biopsy can be used (EVS). Circulating tumour is the most common application mode in the global Liquid Biopsy sector. The market share is greater than 25%. The circulating tumour cell sector generated the largest income in 2020, thanks to an increase in the number of clinically essential tests with genetic analysis in recent years. Furthermore, circulating tumour DNA is expected to be the fastest growing category during the projection period due to the rapid growth of next-generation sequencing (NGS) technologies in liquid biopsy advancements applied to circulating tumour DNA (ctDNA).

- North America will account for nearly 51% of total sales in 2020. The United States leads the regional market due to higher investments and the presence of a number of biotechnology companies that produce the tests. A number of organisations, including the American Society of Clinical Oncology, advocate liquid biopsy (ASCO). As a result, this region's market growth is predicted to quicken. Canada has adopted liquid biopsy testing in the same way that the United States has, allowing FDA-approved tests to be used throughout the country. Furthermore, the market has a large number of biotechnology companies, which is expected to fuel market growth over the forecast period. Increased government subsidies and investments in the development of liquid biopsy tests are expected to boost the market in the country.

- The report contains qualitative and quantitative research on the global Liquid Biopsy Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

Liquid Biopsy Market: Companies Mentioned

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Myriad Genetics, Inc. (US)

- QIAGEN N.V. (Netherlands)

- Thermo Fisher Scientific, Inc. (US)

- Guardant Health, Inc. (US)

- MDxHealth SA (Belgium)

- Exact Sciences Corporation (US)

- Illumina Inc. (US)

- Sysmex Inostics (US)

- Bio-Rad Laboratories, Inc. (US)

- Biocept, Inc. (US)

- NeoGenomics, Inc. (US)

- ANGLE plc (UK)

- Menarini-Silicon Biosystems (Italy)

- Vortex Biosciences, Inc. (US)

- Exosome Diagnostics, Inc. (US)

- Agena Bioscience, Inc. (US)

- MedGenome Inc. (US)

- Epigenomics AG (Germany)

- Personal Genome Diagnostics, Inc. (US)

Read our Strategic Analysis : https://www.businessintelligence-insights.com/press-release/58/liquid-biopsy-market

0