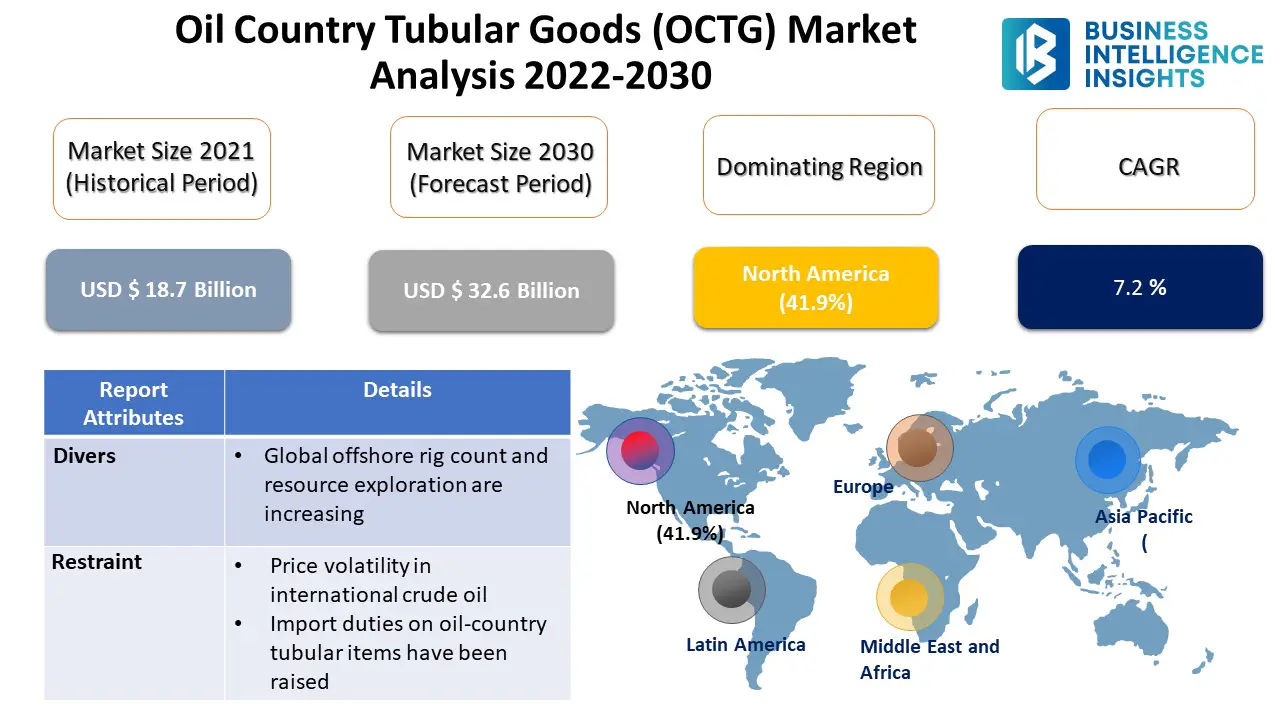

Regional Analysis:

North America dominated the market with more than 41.9% of the market share

The broad expansion of oil and gas reserves in the North American region, both onshore and offshore, would most certainly present significant economic prospects for OCTG firms. Additionally, because oil and gas activities directly affect OCTG demand, increased oil and gas exploration and production operations in the region are likely to raise OCTG demand in the future years. Shale drilling and hydraulic fracturing operations in the United States have increased the use of horizontal and directional drilling activities, adding thousands of feet in the lateral run to previously vertical-only drill strings. Furthermore, according to the Canadian Association of Petroleum Producers (CAPP), investment in new oil and gas projects in Canada is predicted to rise in 2022. As a result of the foregoing, North America is likely to dminate the worldwide oil country tubular products market during the forecast period

By Manufacturing Process

- Electric Resistance Welded (ERW)

- Seamless

Seamless Segment dominated the market with more than 59.1% of the market share

Materials used in the drilling, outfitting, and operation of oil and gas wells include threaded drill pipes, casing, and tubing. The large proportion of the category could be attributed to the growing need for better and more dependable items in the oil and gas industry. When compared to welded counterparts, seamless OCTG products can withstand higher pressures, temperatures, mechanical stress, and corrosive conditions, which explains their increased demand in the oil country tubular goods industry.

By Application

- Onshore

- Offshore

API Grade category dominated the market with more than 69.9% of the market share

Globally, the majority of oil and gas businesses favor API grades, which are less expensive than premium grades. However, as expenditures in offshore E&P grow, the majority of upstream oil and gas operators are migrating toward premium grades of OCTG products. As a result, proprietary grade OCTG is highly valued in the offshore oil and gas business. As a result, premium-grade OCTG sales are likely to increase in the coming

Top Key Players Analysis:

- ARCELORMITTAL SA

- EVRAZ NORTH AMERICA PLC

- ILJIN STEEL CORPORATION

- JFE STEEL CORPORATION

- NOV INC.

- OIL COUNTRY TUBULAR LIMITED

- SUMITOMO CORPORATION

- TENARIS, TMK INC.

- S. STEEL CORPORATION

Read our strategic analysis: http://www.businessintelligence-insights.com/reports/21/oil-country-tubular-goods-octg-market

0