Pumps Industry Data Book Covers Centrifugal Pump and Positive Displacement Pump Markets.

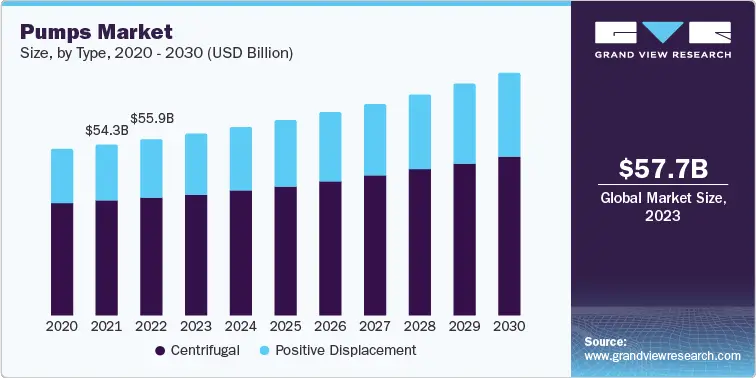

The economic value generated by the pumps market was estimated at approximately USD 57.7 billion in 2023. The demand for pumps is on the rise owing to their varied use in such as water & wastewater, power construction, chemicals, and oil & gas industries. Rising expectations of customers in the past few decades have led to increased spending by the end-user industry globally to improve the quality of industrial pumps along with installing advanced process control. This has led to increased spending by the pump manufacturers in an attempt to improve energy efficiency, which is likely to drive the demand for improved energy-efficient pumps over the forecast period.

Access the Global Pumps Industry Data Book from 2024 to 2030, compiled with details by Grand View Research

Centrifugal Pump Market Growth & Trends

The global centrifugal pump market size was reached to USD 38.6 billion in 2023, expanding at 3.9% CAGR from 2024 to 2030, according to a new report by Grand View Research, Inc. The centrifugal demand has escalated owing to the increase in pump demand for pressure fluids. The pumps are primarily used for accelerating fluids, like water, chemicals, sludge treatment liquids, wastewater, oil, bleaches, and resins.

Increasing demand for water in domestic and industrial applications due to the growing world population is driving the market growth. Expanding population, rapid urbanization, technological developments, and growth in infrastructure have augmented the demand for fresh and processed water across the globe. This in turn is expected to fuel the market growth over the forecast period.

In addition, water scarcity is affecting regions across the globe owing to the lack of freshwater resources, there is an increased need for wastewater treatment to meet the rising demand for clean water. This is expected to drive the global water and wastewater treatment equipment market over the forecast period.

Expanding industrial sectors including food & beverage, chemicals, pulp & paper, pharmaceutical, power, metal & mining, textiles, semiconductors, and oil & gas result in increased consumption of clean water, which is expected to drive the demand for the centrifugal pump industry across the globe.

Manufacturers of centrifugal pumps adopt several strategies including acquisitions, mergers, joint ventures, new product developments, and geographical expansions to enhance their market penetration and cater to the changing technological demand for equipment from various end-use industries such as agriculture, construction & building services, water & wastewater, power generation, oil & gas, chemical, and others. For instance, in October 2022, Sulzer introduces updated features for the AHLSTAR A line of process pumps. AHLSTAR A pumps made of ductile iron have a 180°C temperature limit and a maximum working pressure of 16 bars.

Order your copy of Free Sample of “Pumps Industry Data Book – Centrifugal Pump and Positive Displacement Pump Market Size, Share, Trends Analysis, And Segment Forecasts, 2024 – 2030” Data Book, published by Grand View Research

Positive Displacement Pump Market Growth & Trends

The global positive displacement pumps market size was valued USD 19.1 billion in 2023, growing at a CAGR of 4.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. Positive displacement pumps are crucial components in various industrial applications, and their efficiency is influenced by several driving factors. One key factor is the nature of positive displacement, ensuring a consistent flow regardless of system pressure. The ability to handle high-viscosity fluids and maintain a steady flow rate under varying conditions makes them ideal for processes requiring precision and reliability. In addition, these pumps are often preferred due to their self-priming capabilities, making them effective in situations where a suction lift is necessary.

The product versatility in accommodating different fluids, from thin liquids to highly viscous substances, further contributes to their widespread use in industries, such as oil & gas, chemical processing, and food production. Moreover, advancements in design and materials, as well as the integration of innovative technologies, continue to enhance the efficiency, durability, and overall performance of positive displacement pumps, making them indispensable for critical industrial processes. In industries, such as oil & gas, pharmaceuticals, and food processing, these pumps are favored for their ability to handle shear-sensitive fluids and provide a consistent output. For instance, positive displacement pumps, such as gear or reciprocating pumps, are commonly used to transfer crude oil from production sites to refineries through pipelines.

Crude oil often contains a mix of hydrocarbons with varying viscosities, and positive displacement pumps excel at handling these different fluid properties. The consistent flow provided by these pumps ensures a steady and reliable transfer of crude oil over long distances. The self-priming feature is particularly advantageous in applications like wastewater treatment. These pumps can start and continue to operate effectively even when there is air in the suction line, simplifying the pumping process in systems where maintaining a consistent flow is critical. Moreover, these pumps find extensive use in the food & beverage industry for tasks, such as pumping syrup or handling high-sugar content liquids. The pumps' ability to maintain a consistent flow is vital in ensuring the precise mixing of ingredients and the production of uniform products.

Positive displacement pumps can be designed for high efficiency, contributing to energy savings, and reduced operational costs. This is particularly important in industries where pumps operate continuously, such as water treatment plants, where energy-efficient pumps can lead to substantial long-term savings. Moreover, the need for reliable and efficient fluid-handling solutions is further boosting market growth. Furthermore, growing industrialization in emerging markets, along with increased investments in sectors like oil & gas, chemical processing, and water treatment, is driving product demand. For instance, according to the International Energy Forum, the anticipated annual investment in upstream activities is projected to rise from USD 499 billion in 2022 to USD 640 billion in 2030 to secure ample energy supplies

Go through the table of content of pumps Industry Data Book to get a better understanding of the Coverage & Scope of the study.

Competitive Landscape

Key players operating in the Pumps Industry are –

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT INC.

- Sulzer Ltd.

- EBARA International Corporation

- Ingersoll Rand

- KSB SE & Co. KGaA

- Iwaki America Inc.

- HERMETIC-Pumpen GmbH

- Vaughan Company Inc.

- SPX Flow

Global pumps sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook report and summary presentations on individual areas of research.