The Indian payments industry is undergoing a revolutionary transformation. Fueled by a burgeoning internet population and government initiatives like Digital India, digital payments are rapidly replacing traditional cash transactions. Understanding the key players and navigating this dynamic landscape is crucial for both consumers and businesses.

Demystifying the Ecosystem: Payment Banks, Gateways, and More

Let's delve into some key terms that define the payments sector:

- Payment Banks in India: These are a relatively new category of banks in India, authorized to accept deposits up to a specific limit but not offer loans. They primarily focus on facilitating basic banking services and digital payments in rural and underserved areas.

- Payment Gateway (India & Globally): An Indian payment gateway acts as a secure intermediary between merchants (online stores) and customers. It encrypts sensitive financial information, processes payments from various sources like credit cards, debit cards, net banking, and wallets, and settles funds with the merchant. This service is crucial for enabling seamless online transactions.

Study about Australia Cards and Payment Market

Digital Payment Methods: Powering the Cashless Revolution

The rise of digital payments has brought a plethora of options to Indian consumers:

- Unified Payments Interface (UPI): This innovative system allows instant money transfers using a virtual payment address (VPA) linked to your bank account. UPI has emerged as a frontrunner, with over 7 billion transactions processed in February 2024 alone.

- Mobile Wallets: These digital wallets store your credit/debit card information and allow one-click payments at online stores and physical merchants with compatible Point-of-Sale (POS) systems. Paytm, PhonePe, and Google Pay are some leading mobile wallets in India.

- BHIM: Launched by the National Payments Corporation of India (NPCI), BHIM is a mobile app that leverages UPI for instant money transfers.

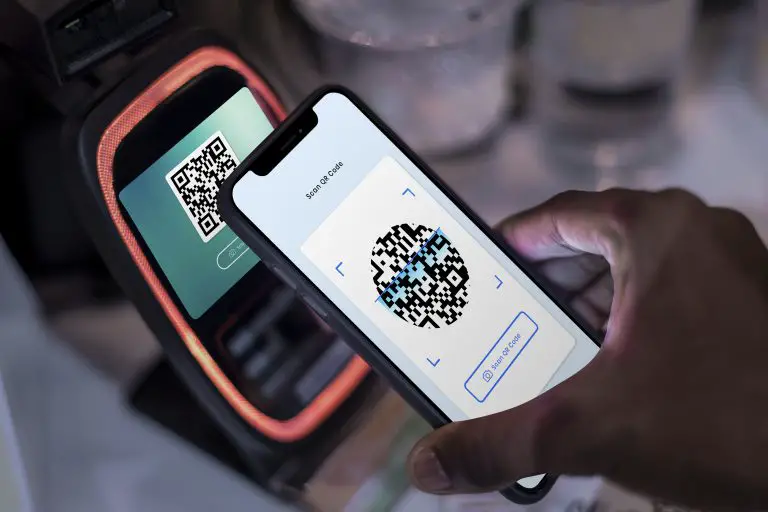

QR Code Payments: A Global Phenomenon with Local Impact

QR code payments, where a customer scans a QR code displayed by the merchant to initiate a payment, are gaining traction in India. While not as ubiquitous as in countries like Singapore, QR code payments offer a convenient and contactless solution for both small businesses and established retailers.

Cashfree Payment: A Player in the Indian Payments Game

Cashfree Payment is a prominent name in the Indian payments sector, offering a comprehensive payment gateway solution for businesses. They specialize in integrating various payment methods like UPI, mobile wallets, net banking, and credit/debit cards into a single platform, simplifying online payment acceptance for merchants.

Combating Online Payment Frauds: A Shared Responsibility

With the rise of digital payments, online payment frauds are a growing concern. Here are some ways to stay vigilant:

- Beware of phishing scams: Don't click on suspicious links or share your financial information on unverified websites.

- Enable two-factor authentication (2FA): This adds an extra layer of security by requiring a one-time password (OTP) for transactions.

- Choose reputable payment gateways: Opt for merchants that use secure payment gateways with robust fraud prevention measures.

Digital Payment in E-Commerce: Driving Growth and Convenience

The integration of digital payments in e-commerce platforms has revolutionized online shopping in India. Customers enjoy a faster and more convenient checkout experience, leading to increased online sales and a boom in the e-commerce sector.

Understanding Industry Insights: Reports and Questionnaires

Staying informed about the payments industry trends is crucial for businesses and consumers alike. Here are some resources:

- Online Payment Reports: Market research firms like Statista and Mordor Intelligence publish reports analyzing the Indian payments market size, growth projections, and key trends.

- Online Payment Questionnaires: Participating in surveys conducted by industry bodies or research institutions can provide valuable insights into consumer preferences and payment habits.

The Payments Market: Major Players and the Road Ahead

The Indian payments market is a vibrant space with a diverse set of players, including traditional banks, payment gateways, digital wallets, and fintech startups. Some major players to watch include:

- NPCI: The National Payments Corporation of India is a key driver of innovation in the payments space, developing the UPI platform and promoting interoperability between different payment systems.

- RBI (Reserve Bank of India): The central bank plays a crucial role in regulating the payments industry and promoting financial inclusion.

Learn about Global Capital Markets vs. Investment Banking: Size & Research

Conclusion

The Indian payments market is poised for continued growth, driven by increasing internet penetration, smartphone adoption, and government initiatives. As the ecosystem evolves, consumers can expect even more convenient, secure, and innovative ways to pay. By understanding the different players, payment methods, and best practices, you can become an active participant in this exciting digital revolution.