Even a financially sound person can't predict uncertainties well in advance. An unexpected event can affect you financially or can dig up a big hole in your pockets. Also, financial stability is not a fixed thing. There are always ups and downs, which directly or indirectly depends on your needs. It is always good to have a backup plan before you get stuck in any financial emergency. To meet the uncertain events and avail of instant cash without blocking the savings, it is always advised to apply for an instant personal loan. It is a type of unsecured loan that the borrowers are expected to usually pay back in monthly instalments along with the interest rate. Most lenders look at various factors like borrowers' creditworthiness, salary, etc., to calculate the interest rate. Keep reading to know the reasons why a borrower should apply for a personal loan to meet urgent cash requirements.

Consolidate Debts

Consolidating debts is one of the most important reasons why people apply for an instant loan. If you can pay off your costly debts with the personal loan amount, you’ll only have a fixed monthly payment for the personal loan. In addition, it can help you save money on interest if you can secure a personal loan at a low-interest rate. This is conceivably the most adaptable choice for when you want to consolidate your debts. It also gives you a flexible tenor option for suitable repayment. A personal loan for debt consolidation can help you in the following ways:

- Extend your repayment term

- Lower your monthly payments

- Free your income to pay off necessary expenses

Cover Unplanned Expenses

There are many uncertain events that you cannot predict well in advance. An emergency personal loan can help you cover all these unplanned emergency expenses. You can use these funds either in any of the events:

- Job loss or reduced hours

- Auto repairs

- Medical costs

- Help for a friend or family member

For Home Repairs

While you have a dream to build an upgraded home, there are some health and safety issues related to repairs that need immediate action. For urgent issues like broken heating or air conditioning systems, blocked pipes, or gas leaks that require immediate attention, it is always advisable to apply for an instant personal loan.

Finance Funeral Expenses

When the bread earner of the family dies, it can put up strain on the family members of the demised person. A funeral loan can be the best alternative if you are struggling to cover up the funeral cost.

Help Cover Up the Moving Debts

One can move out of their homes for the following reasons:

- If they don’t feel safe in their current environment

- Separating from your spouse

- Job offer in another location

- You need more space for a child on the way etc.

You can apply for an instant loan to cover up the moving debts for all these reasons. However, before applying for a loan, you must calculate whether your new income will cover the added moving expenses.

Make a Large Purchase

Making a large purchase from your savings can leave you with zero cash in your hand. You can apply for a personal loan to make large purchases and make the payments according to your repayment tenure preference in small and easy instalments.

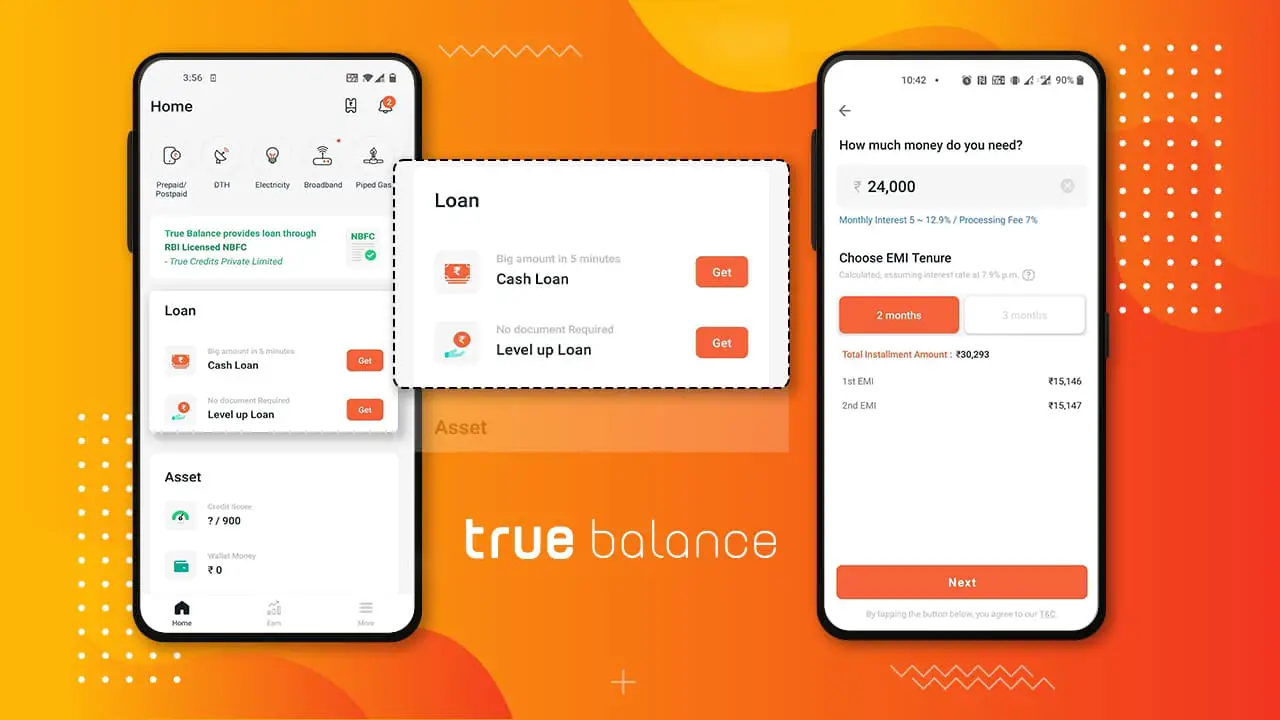

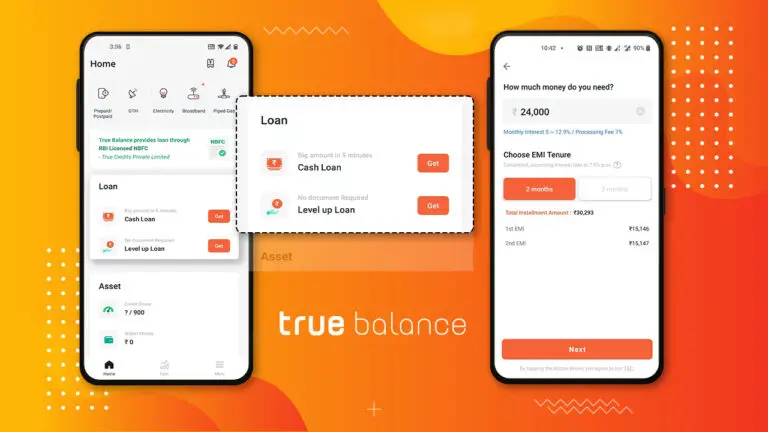

For a quick and hassle-free instant personal loan, you can download the TrueBalance loan app from the Google Play Store. It is one of the best loan apps that lets borrowers avail of loans during times of financial crisis. The best part is you can avail instant loan at an affordableinterest rate in just a few minutes. Avail a personal loan in just five easy steps. For more details, check the TrueBalance loan app now!

0