Square cash app is presently accomplished a tremendous measure of a client base. Because of its simplicity of activity and shared cash Transfer. Interference in administration regularly leaves your cash in cash app limit. Square Inc. uncovered open information in 2017 that the cash app is utilized by 7 million clients consistently.

With these payment disappointment issues, it is very basic for clients to think cash app failed for my protection of cash. Cash app likewise permitted the deal/acquisition of Bitcoin, which can be additionally an explanation of intrusion in administration. Cash App authorities guaranteed that these issues experience because of the server blackout. Be that as it may, this sort of issue brings doubt up in the client’s brain.

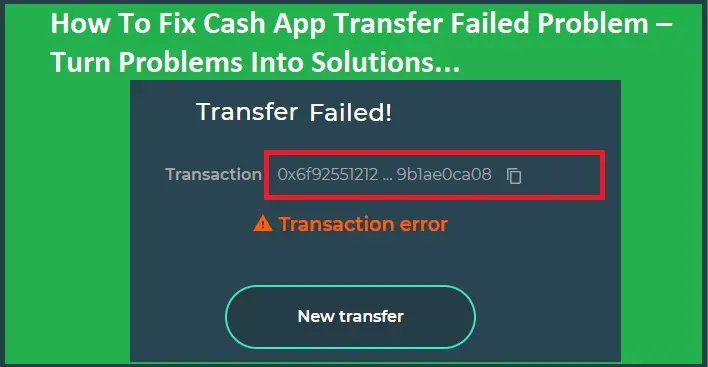

1-Find The Hub Of Exchange Disappointment: Before bouncing in the end that the whole cash app isn’t working check your cash app parity over the screen. On the off chance that the dollar sum isn’t appearing true to form c check your connected financial balance to see whether an exchange isn’t pending. You ought to do this activity before accepting the cash app this transfer failed. Do it before dropping or refreshing the exchange.

2-Cancel The Payment: On the off chance that your exchange is noticeable in financial balance but not affirmed by the cash app, dropping the payment can keep away from your store to get solidified because cash is still on your side and not get by a beneficiary. You need to drop the payment within 24 hours of sending with the goal that your store won’t be deducted from a ledger. In such a case you won’t see the choice of dropping the payment.

3-Dispute The Charge: If cash app failed to give a discount, at that point you should contact your card issuing bank or credit organization. You can pursue the above strides to recover and shield your store from stalling out.

In any case, the cash app is continually saying that these issues happen when the organization experiences network issues. In any case, they should keep this thing in their mind that the client endures in the end all things considered.

A client doesn’t in charge of your server blackouts whatnot. If incapable to make an exchange and their cash stuck they reserve each option to feel that the cash app failed for my protection of assets.

Since the clients are utilizing your administration to make their life simpler yet the event of such disagreeable occasions makes it hopeless. Square cash app Inc. must make its framework powerful so clients can confide in you with their well-deserved cash.

Cash App Failed For My Protection – Cash App Payment Failed

With the repetitive event of issues of cash app transfer failed, cash app payment failed regularly go as far as anyone is concerned. This is recoloring their image picture. If you cannot verify the cash of the client by what means can a client trust you with their cash? On the off chance that we keep an eye on a few

The majority of them likewise whine that cash app customer support doesn’t give them an appropriate reaction and they are not keen on settling their issues.

Such sort of audits is awful for an organization. Square Inc. is so glad about their cash app authority and they advance it as a simple and secure payment technique.

Then again clients are enduring the finding of unjustifiable charges and there are no goals of their complaint from the cash app side.

Cash app has now a colossal client base of 15 Million according to 2018 information. Cash app currently has a surprising piece of the overall industry alongside PayPal and Venmo.

Presently they should have remarkable customer support and fewer blackout issue alongside zero. On the off chance that clients got their cash solidified, at that point for what reason will they utilize the administration for next time? Then again, it will offer ascent to extremely sass exposure for the organization.

At the point when the cash app failed for my protection of assets. Client criticism and positive audits enhance the organization. It is imperative to hold clients who are experiencing issues and loaded up with pessimism. Since toward the end, the client is the best.

0